Industry ResearchNews

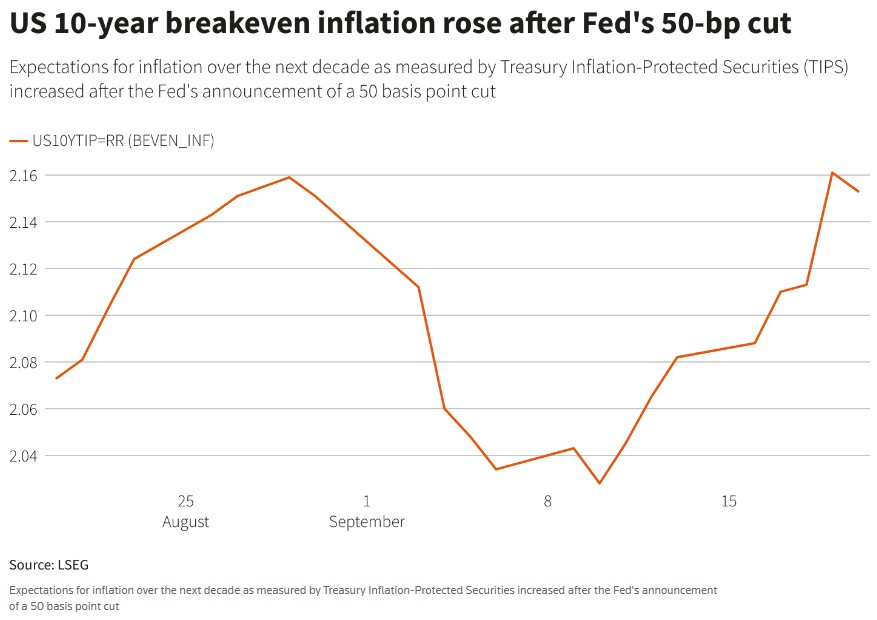

In the current economic situation, the Federal Reserve has launched a new round of easing with a 50 basis point interest rate cut, which has attracted a lot of attention. This action not only has a significant impact on the US economy and the global economy, but also brings a series of chain reactions to the US real estate market and related industries. At the same time, market liquidity and government policy regulation are closely related to the real estate market in this economic context, and many details are worth in-depth analysis.1、 The macroeconomic impact of the Federal Reserve's interest rate cuts(1) The impact on the US economyThe Federal Reserve's interest rate cut this time aims to stimulate US economic growth, promote employment, and help the economy achieve a soft landing by lowering interest rates. This decision has an important guiding role in the trajectory of the domestic economy in the United States and is expected to inject new vitality into economic development.(2) The impact on the global economyFrom a global perspective, the Federal Reserve's interest rate cuts have a wide-ranging impact. On the one hand, it reduces the negative spillover effects of US monetary policy on other countries, such as exchange rate depreciation, capital inflows, and capital market fluctuations, which can be alleviated to a certain extent. On the other hand, this interest rate cut also provides a reference for central banks of various countries to adjust their monetary policies. In this week's global "central bank super week", except for the Bank of Japan, which remained inactive, other central banks are likely to announce interest rate cuts. The European Central Bank has even rushed to announce interest rate cuts twice in advance, which shows its far-reaching impact.2、 Direct impact on the US real estate market(1) Stimulating the demand for home purchasesAfter the Federal Reserve significantly lowered interest rates, it significantly reduced the loan burden on homebuyers. Taking a house worth $500000 as an example, if the loan interest rate before the interest rate cut was 5%, the buyer would repay approximately $2684 per month; After the interest rate cut, assuming the loan interest rate drops to 4%, the monthly repayment will be reduced to about $2421, and the monthly repayment burden will be reduced by nearly $263. The significant reduction in burden has led to a surge in demand for housing among those who were originally in a wait-and-see state, as they flock to the real estate market. According to historical data, after several interest rate cuts by the Federal Reserve, the average demand for home purchases has increased by about 20%. As a result, many first-time homebuyers and young families have seen opportunities to realize their housing dreams and actively engaged in the search for suitable properties.(2) The trend of changes in housing pricesIn the early stages after interest rate cuts, housing prices usually show an upward trend. This is due to the influx of more homebuyers leading to a sharp increase in demand, while the supply in the real estate market is difficult to keep up quickly in a short period of time, and the imbalance between supply and demand is driving up housing prices. However, changes in housing prices are not absolute. If consumers hold a pessimistic attitude towards the future economic outlook, they may choose to wait and see, leading to a decrease in market activity. For example, in the current economic situation, although interest rates have decreased, some consumers are concerned that economic recession may lead to unemployment or income reduction, so they are cautious about buying a house. In this case, the effect of interest rate cuts may be offset. From historical data, after several interest rate cuts by the Federal Reserve, housing prices have generally experienced significant increases, but there are also some exceptions. In certain specific economic environments, housing prices did not immediately rise, and even fluctuated.3、 Chain reaction on related industries(1) Changes in the US Home Furnishing MarketAfter the Federal Reserve cut interest rates, the US home market has ushered in new changes. From the perspective of inventory growth rate of furniture and home furnishings wholesalers in the United States, the growth rate turned negative in April 2023 and fell to -16.56% in September 2023, and then the decline gradually narrowed. As of July 2024, the monthly growth rate has converged to -5.74%, indicating that the destocking cycle of furniture and home furnishings in the United States is approaching its end. With the arrival of interest rate cuts, the demand for household goods is increasing, and the replenishment cycle is expected to begin.According to data from the General Administration of Customs of China, the total export value of furniture and its parts in China reached 44.893 billion US dollars from January to August 2024, an increase of 9.9% compared to the same period last year. The total export value in August was 4.842 billion US dollars. In terms of product categories, the growth rate of export value for sofas, mattresses, and flooring has improved since the second half of 2023. The export growth rate of most sub categories has turned from negative to positive in the first quarter of 2024, showing a significant improvement. As of July 2024, mattress and some sofa types still maintain a double-digit growth trend.From the inventory to sales ratios of furniture retailers and wholesalers in the United States, the inventory to sales ratios in July 2024 were 1.54 and 1.89, respectively, ranking in the 34th and 78th percentiles of the past decade. Retailers' inventory is in the historical low range and there is a demand for replenishment, while wholesalers' inventory sales ratio is in the historical high range and still needs further destocking. After the Federal Reserve initiates interest rate cuts, the inventory to sales ratio is expected to further improve, leading to a replenishment cycle. The Fed's interest rate cuts are expected to drive the growth of China's furniture exports, and China's furniture exports are expected to continue to maintain a high momentum in the second half of 2024.(2) Opportunities and Challenges for Real Estate DevelopersFor real estate developers, the Federal Reserve's interest rate cuts have brought both opportunities and challenges.In terms of opportunities, American developers with short development cycles, low land cost ratios, and a focus on current home sales are expected to benefit from the housing demand released after interest rate cuts. Firstly, the low interest rate environment reduces the financing costs for developers. For example, a medium-sized real estate developer's financing cost before the interest rate cut was an annual interest rate of 6%, which may decrease to 4.5% after the cut. For a project worth $100 million, it can save millions of dollars in interest expenses annually. Secondly, the increasing demand for home purchases has brought more sales opportunities for developers. With the decrease in loan interest rates, more homebuyers are entering the market, the speed of property sales is accelerating, inventory is decreasing, and developers can adjust their sales strategies according to market demand, increase housing prices or launch more high-end real estate projects to obtain higher profits.However, developers also face many challenges. On the one hand, land costs may rise with increasing demand for home purchases. In some popular areas, land competition is fierce, and developers may need to pay higher prices to obtain suitable land. On the other hand, market competition may also intensify, and more developers may enter the market to compete for limited land resources and homebuyers, which may lead to price wars and competition in project quality, putting pressure on developers' profitability.4、 Market recovery? Liquidity is recoveringMedia reports indicate that market liquidity is currently recovering in various ways. More companies are willing to provide loans for the purchase of commercial real estate, such as Michael Gigliotti, Senior Managing Director of Jones Lang LaSalle Inc., who stated that an investor planning to acquire a Florida warehouse real estate portfolio and seek $120 million in financing has received 12 offers from major banks and insurance companies, up from four to five offers three months ago.In addition, investment giants are also preparing to provide certain loans, although the interest rates are higher than a few years ago. Fortress Investment Group and Goldman Sachs Group Inc. are seeking to raise funds from investors for a new commercial real estate loan real estate investment trust fund. According to CEO Robert Wasmund, Ascent Developer Solutions, a lender supported by Elliott Investment Management, stated that loan demand has doubled compared to two to three months ago.Data shows that the commercial mortgage-backed securities market has regained vitality since the beginning of this year, with new issuances reaching $92.5 billion as of July, a 57% increase from the same period in 2024. Madison Realty Capital has secured a $2.04 billion equity commitment for its real estate debt fund, which fully demonstrates the gradual recovery of market liquidity.5、 The impact of government policy regulation on the US real estate marketThe government's policy regulation also plays an important role in the US real estate market. Real estate tax, as an important source of revenue for governments below the state level, may affect the real estate market by adjusting real estate tax policies. For example, by increasing or decreasing the real estate tax rate, it affects the holding cost of property owners, thereby affecting the market supply and demand relationship.

2024-11-24View Details

The direction of the US real estate market in 2024 has become a focus of attention from all walks of life, with many complex factors intertwined, jointly outlining the overall market picture of this year. Among them, macroeconomic environment, regional policies, changes in various market demands, monetary policy, fiscal policy, and housing policy all have a profound impact on the real estate market, especially the villa market, in the Houston, Austin, and Dallas areas. The following will provide a detailed analysis of this.1、 The impact of macroeconomic environment on the real estate marketAgainst the backdrop of the ongoing global economic adjustment in 2024, the trend of interest rates in the overall US economy has a significant impact on the real estate market. If interest rates remain relatively stable or moderately decrease, it will attract more potential homebuyers to enter the market, and the real estate markets in key areas such as Houston, Austin, and Dallas will also benefit from it.2、 The promotion and restriction of regional policies on real estate(1) Houston AreaThe Houston government is expected to continue implementing policies to encourage real estate development and investment. For example, providing tax incentives or construction subsidies to villa projects that meet environmental standards to encourage developers to create green and environmentally friendly villas. At the same time, in order to alleviate housing pressure, the government may adjust land planning, increase available land for villa construction, and expand the supply of villa housing in the market.(2) Austin areaAustin's policy orientation focuses on attracting talent and promoting technological innovation. In terms of the real estate market, the government will increase investment in the construction of supporting facilities around science and technology parks, including roads, schools, hospitals, etc. The improvement of these supporting facilities will significantly enhance the value of surrounding villas and attract more home buyers and investors.(3) Dallas AreaThe policies in the Dallas area revolve around promoting economic diversification and improving residents' quality of life. The government may encourage residents to purchase villas by providing low interest loans, while strengthening market supervision, regulating market order, safeguarding the legitimate rights and interests of homebuyers and investors, and creating a favorable development environment for the villa market.3、 The changing trend of demand in the villa market(1) Residential needsIn the Houston, Austin, and Dallas areas, people's demands for living space and comfort in villas are increasing. With the popularity of remote work mode, villas with independent study rooms or multifunctional rooms are more popular, and outdoor spaces such as gardens and terraces in villas are also receiving attention. The buyer expects to enjoy a comfortable outdoor life in the villa during their spare time from work.(2) Investment demandVillas will remain a key focus for investors in 2024 due to their high potential for value preservation and appreciation. Investors in Houston tend to prefer villas near the core areas of the energy industry, which can yield higher rental income; Austin investors focus on villas around technology parks, whose value is expected to rise with the development of the technology industry; Dallas, on the other hand, prioritizes investing in villas located around its core commercial areas within a diversified economic structure.4、 The Development Prospects of the Rental Market(1) Houston AreaWith the recovery of the energy industry and the increase of migrant population, the villa rental market in Houston is expected to grow steadily. Owners of rental villas can enhance their competitiveness and attract more tenants by providing personalized services such as fully equipped furniture and regular cleaning.(2) Austin areaThe rental market in Austin will continue to benefit from the development of the technology industry, with tenants mainly consisting of high-tech talents who have high requirements for the quality and supporting facilities of rental villas. Owners should pay attention to improving the overall quality of the villa when renting it out, and equip it with modern home appliances and high-speed internet.(3) Dallas AreaThe villa rental market in the Dallas area is showing a diversified development trend. On the one hand, economic development has led to an increase in demand for high-end villa rentals; On the other hand, villas with moderate prices and high cost-effectiveness are also attracting a large number of tenants' attention. Owners can adjust the rental price reasonably according to market demand and increase the occupancy rate.5、 The impact of monetary policy on the real estate marketThe Federal Reserve's interest rate decisions have a significant impact on the real estate market. In 2024, if the Federal Reserve maintains the current interest rate level or further cuts interest rates, it will stimulate the real estate market. Lower interest rates can reduce the cost of purchasing a house, alleviate the pressure of mortgage loans on homebuyers, increase market demand, drive up housing prices, and stimulate real estate transactions. Both self occupied and investment demand will increase.6、 The impact of fiscal policy on the real estate market(1) Tax policy adjustmentThe government may adjust taxes related to real estate. In terms of income tax, tax incentives may be introduced for homebuyers, such as increasing the pre tax deduction amount for home loan interest or providing exemptions for first-time homebuyers to encourage home purchases. In the process of property ownership, the property tax rate will be adjusted according to the market conditions in different regions. In overheated areas, it may be raised to curb speculative buying, while in depressed areas, it may be lowered to reduce the burden on property owners and promote stable market development.(2) Subsidies and welfare policiesTo promote the development of the real estate market, the government may introduce housing subsidies and welfare policies. California has provided down payment subsidies for first-time homebuyers or housing subsidies for specific income groups, which can help lower the threshold for home purchases and increase market demand. In addition, the government may also provide rental subsidies to alleviate housing pressure and affect the supply and demand relationship in the rental market.(3) Increased investment in public housing constructionThe government may increase investment in public housing construction to address the housing shortage issue, including increasing funding, planning and constructing more affordable housing projects, and meeting the housing needs of low-income groups. This move not only increases housing supply, but also stabilizes market price levels, drives the development of related industries, and promotes economic growth.7、 The impact of housing policies on the real estate market(1) Strengthen the supervision of the real estate marketThe government may further strengthen its supervision of the real estate market, regulate market order, and prevent risks. Including strengthening the supervision of developers, real estate agencies, and market transactions, issuing strict regulations to limit the number of home purchases, reviewing the sources of home purchase funds, etc., to curb speculative demand for home purchases.(2) Promote the diversification of housing supplyThe government may encourage the diversification of housing supply. In addition to the development of traditional commercial housing, we will increase support for the rental housing market, encourage the development of long-term rental apartments and other forms of rental housing, and provide relevant incentives to attract enterprises and investors to participate. At the same time, we support the development of new housing models such as shared ownership housing, allowing homebuyers to choose their property rights based on their economic strength, lowering the threshold for purchasing a house, and achieving diversified housing security.(3) Promote the coordination between urban planning and real estate developmentThe government may place more emphasis on coordinating with real estate development in urban planning. Through scientific and rational urban planning, optimizing land use layout, determining land use and development intensity in different regions, and guiding real estate development. For example, improving the infrastructure construction of emerging regions to enhance their attractiveness, guiding development towards this direction, and achieving balanced urban development. At the same time, we will strengthen the renovation and renewal of old urban areas, encourage developers to participate, improve the living environment and quality, and bring new opportunities to the market.In summary, the real estate market in Houston, Austin, and Dallas in 2024, particularly the villa market, presents both opportunities and challenges. Homebuyers, investors, and renters need to closely monitor market trends and make wise decisions based on their own needs and actual situations. Our website will continue to provide you with the latest and most comprehensive real estate information, helping you achieve your goals in the real estate market.

2024-11-24View Details

Analysis of Tax Advantages of Real Estate Investment in Texas, USA

Investing in real estate in dynamic areas such as Houston, Austin, and Dallas in Texas not only presents potential high-yield opportunities, but also has tax advantages in terms of income tax and property tax, which can significantly increase investors' actual returns and create a favorable environment for long-term investment. Below is a detailed explanation for you.1、 Advantage of no state income taxTexas is one of the few states that does not levy state income tax, which is of great significance to real estate investors. Compared to regions that levy state income tax, investors in Texas do not need to deduct state income tax from rental income or profits from property sales when investing in real estate.For example, investing in real estate in other states with an annual rental income of $50000 would result in an annual state income tax of $2500 if the income tax rate is 5%; In Texas, rental income does not need to pay this tax, and the funds can be used for property maintenance, upgrades, or other investment areas to increase property value or expand investment scale. When selling a property, if a profit of $200000 is made in another state, significant taxes may need to be paid; In Texas, profits can be fully retained for reinvestment or personal financial planning.2、 Preferential policies for property tax(1) The tax rate is relatively stableThe property tax rate in Texas is relatively stable, and investors can accurately predict the cost of holding property when making long-term investment plans, without causing a sharp increase in costs due to significant fluctuations in tax rates, ensuring investment stability.(2) Fair evaluation mechanismThe Texas property valuation mechanism is relatively fair to investors, taking into account factors such as market conditions and actual property conditions. Investors who maintain and upgrade their properties can avoid bearing excessive property taxes due to overvaluation through reasonable evaluation.(3) Special exemptions and reductionsTexas has property tax exemptions and reductions policies for specific situations. If disabled veterans and their spouses meet the conditions, they can enjoy full or partial exemption; Investing in properties for specific public welfare purposes, such as providing low-income housing, may also have corresponding exemption policies.3、 1031 Similar Property Exchange PolicyThe 1031 similar property exchange policy in the US federal tax law is equally applicable and important in real estate investment in Texas. Investors who sell a property (abandoned property) and purchase another similar property (substitute property) within a specified time (usually determined within 45 days and completed within 180 days) can defer capital gains tax on the sale of abandoned property.For example, if an investor owns a villa in Houston and sells it, they may face high capital gains tax. If they use this policy to find a villa investment in Dallas or Austin within the specified time, the capital gains tax that should have been paid can be deferred until the new property is sold. This policy provides flexibility for investors and promotes the rolling development of real estate market transactions and investments.4、 Depreciation deduction advantageDepreciation deduction is an important tax advantage when investing in real estate in Texas. Investors can depreciate their investment properties and deduct corresponding expenses in tax declarations.Residential properties are generally depreciated over 27.5 years. Assuming an investment of $500000 in a villa in Austin, the annual deductible depreciation expense is approximately $18182 ($500000 ÷ 27.5 years). This can reduce the taxable income of investors, lower the tax burden, and even if the market value of real estate increases, they can still enjoy depreciation tax benefits.5、 Investment costs are tax deductible(1) Repair and maintenance costsInvestors can deduct normal maintenance and upkeep costs for villas, such as repairing roofs, replacing pipes, etc., when calculating taxable income, which can reduce actual costs.(2) Property management feesHire a property management company to manage the villa, and the property management fees paid can be used as operating costs to offset taxes, including daily management, security, green maintenance, and other expenses.(3) Loan interestInvestors who purchase real estate through loans can deduct the loan interest paid in their tax declaration, which is an important tax benefit for investors who use leverage investment and can reduce financing costs.In summary, investing in real estate in the aforementioned areas of Texas offers numerous tax advantages, including no state income tax, property tax incentives, 1031 policies, depreciation deductions, and investment cost tax deductions. Investors should fully grasp these advantages to reduce investment costs, increase returns, and achieve long-term stable development. Both beginners and experienced individuals should conduct in-depth research and utilize them.

2024-11-24View Details

The sales volume of existing homes in the United States increased by 2.9% year-on-year in October

In the complex operation of financial markets, multiple factors are intertwined and affect the trend of currency exchange rates. On November 21st, the United States showed a trend of positive real estate sales data and a rebound in market hedging demand, which had a significant impact on the US dollar exchange rate. Many related details are worth further analysis.1、 The overall trend of the US dollar index and exchange rateOn that day, the US dollar showed different trends against different currencies, which in turn affected the performance of the US dollar index. The US dollar index showed a narrow consolidation state in the overnight market and early morning of the day, then quickly rose in the morning of the day, and then entered a narrow consolidation stage. By the end of the day, the US dollar index had significantly risen. After a day of fluctuations, the US dollar index, which measures the exchange rate of the US dollar against six major currencies, rose by 0.27% on that day and ultimately closed at 106.97 in the foreign exchange market.2、 US real estate sales and their impact on the US dollarThe data released by the American Association of Real Estate Agents this morning brought important information to the market. Data shows that the annual sales rate of existing homes in the United States reached 3.96 million units in October, which is higher than the market expectation of 3.9 million units and also higher than the revised 3.83 million units in September. The good performance of real estate sales has become one of the factors driving the fluctuation of the US dollar exchange rate on that day, enhancing market confidence in the US dollar and thus affecting the exchange rate trend of the US dollar against other currencies to a certain extent.3、 Analysts' views on short selling the US dollarMatt Simpson, a senior analyst at online brokerage firm Jiasheng Group, has provided insights into the current market situation. Given that investors are increasingly considering the possibility that the Federal Reserve may not cut interest rates at its December meeting, Simpson believes that it is quite difficult to short the US dollar in the current situation. This viewpoint indirectly reflects that the market's expectations for the US dollar are relatively stable, and investors are more cautious when making decisions.4、 The Impact of Russia-Ukraine conflict on Currency Exchange Rate(1) The impact on the EuroThe situation of the Russia-Ukraine conflict has had an obvious impact on the euro exchange rate. Simpson pointed out that the Russia-Ukraine conflict is heating up, which further weakened the market's confidence in the euro. Moreover, the prospect of the United States imposing trade tariffs has put the Euro, which is sensitive to the trade situation, in a negative position. The combination of multiple unfavorable factors led to a decline in the euro to dollar exchange rate on that day. As of the end of the New York currency market, 1 euro was exchanged for 1.0484 US dollars, lower than the previous trading day's 1.0539 US dollars.(2) The impact on the Japanese yenMonex US, a foreign exchange broker, revealed the impact of the Russia-Ukraine conflict on the yen exchange rate in the morning of the 21st. After Ukraine launched long-range missiles produced by the West into Russian territory, the market began to believe that there were more practical risks in the Russia-Ukraine conflict. Although this concern has largely been reflected in the support for the US dollar, if this concern comes true, there is still room for further appreciation in other safe haven currencies.The performance of the Japanese yen has been particularly outstanding this week, continuing to show extreme volatility. In the morning of that day, the Japanese yen strengthened by nearly 1% against the US dollar. Geopolitical risks have long been the main driving factor for the US dollar to Japanese yen exchange rate, and this week is no exception. The latest escalation of the Russia-Ukraine conflict has brought strong risk aversion support to the yen. At the same time, Kazuo Ueda, governor of the Bank of Japan, intensified the strength of the yen with his strong voice on the recent decline of the yen in Europe on the 21st. Moreover, Kazuo Ueda stated that the Japanese government is closely monitoring the impact of the yen exchange rate on the economy and inflation. This move injects new uncertainty into the Bank of Japan's interest rate meeting in December, further affecting the trend of the yen exchange rate.5、 Exchange rates of major currencies against the US dollar at the end of the New York currency marketAs of the end of the New York currency market, the exchange rates of major currencies against the US dollar have shown varying degrees of change. In addition to the exchange rate fluctuations of the Euro and Japanese Yen mentioned above, the exchange rate of 1 pound to 1.2602 US dollars is lower than the previous trading day's 1.2647 US dollars; 1 US dollar is exchanged for 0.8863 Swiss francs, higher than the previous trading day's 0.8844 Swiss francs; 1 US dollar is exchanged for 1.3964 Canadian dollars, lower than the previous trading day's 1.3984 Canadian dollars; 1 US dollar is exchanged for 11.0508 Swedish kronor, higher than the previous trading day's 11.0327 Swedish kronor. These exchange rate changes reflect the combined effects of various factors such as the global economic situation and geopolitics on the day.

2024-11-24View Details

The Current State of the US Real Estate Market: Growth and Challenges Coexist, Trends to be Observed

The US real estate market has recently shown a complex trend, with an increase in current home sales in October and a rise in mortgage rates to higher levels. This situation has sparked many discussions on market trends, such as whether the growth of existing home sales can be sustained, and where future mortgage interest rates will go. Many industry insiders have also provided their own insights and analyses based on this, which will be elaborated in detail below.1、 Current situation of current house sales and mortgage interest rates(1) Real estate sales growthAccording to the latest data from the National Association of Realtors (NAR), current home sales in the United States showed a positive growth trend in October, with a month on month increase of 3.4% and a year-on-year increase of 2.9%. This is the first time since July 2021 that year-on-year growth has been achieved, bringing a touch of warmth to the market and igniting people's expectations for market recovery.(2) Mortgage interest rates riseHowever, the situation of mortgage interest rates is not optimistic. According to data from Freddie Mac, the average interest rate for 30-year standard fixed mortgage loans in the United States has risen to 6.84%, reaching a new high in four months. High mortgage interest rates have brought enormous pressure to real estate transactions and raised doubts about whether the growth of existing home sales can be sustained. Is this the starting point of market recovery or a short-lived prosperity?2、 The Evolution and Future Trends of Mortgage Interest Rates(1) Fluctuations in the past three yearsIn the past three years, the average mortgage interest rate in the United States has fluctuated dramatically, with astonishing increases. On August 19, 2021, the average 30-year fixed interest rate was 2.86%, which had risen to 6.84% as of November 21. Especially after the Federal Reserve cut interest rates in September, mortgage rates did not fall as expected, but continued to rise, forming a strong contrast with market expectations.(2) Future trend predictionMultiple parties have made predictions on the future trend of mortgage interest rates. Ansari, a foreign IQI group, pointed out that the interest rate of US housing loans closely followed the yield of 10-year treasury bond bonds, and the yield of treasury bond bonds recently soared to 4.41% from 3.62% on September 26. Redfin has raised its forecast for the average 30-year mortgage interest rate for 2025 to 6.8% after the US election, while institutions such as Moody's Analytics expect the rate to remain around 7% next year. Oxford Economic Research Institute believes that although the interest rate of treasury bond has stabilized, considering the risks of economic growth, interest rate reduction by the Federal Reserve and Trump's government policy, the interest rate still has an upward risk. Chen Hongming from Washington D.C. predicts that mortgage interest rates may remain around 6% in the short term, and it is highly unlikely that they will return to the initial 2% level of the pandemic in the short term. Inflation concerns are causing investors to worry.3、 Housing loan application volume and housing supply situation(1) Changes in loan application volumeDespite the consecutive four week increase in mortgage interest rates, the number of home loan applications has shown an unexpected trend. Previously, it had been declining for two consecutive months, but in the week ending November 15th, according to the Mortgage Bankers Association (MBA) data, the number of mortgage applications increased by 1.7% compared to the previous week, indicating that although mortgage interest rates are high, there are still some consumers who have a demand for home loans and their willingness to buy a house has not been completely extinguished.(2) Housing supply situationThe supply of housing increased in October, with a total of 1.37 million units for sale, a year-on-year increase of 19.1%. However, it should be noted that the increase in supply is partly due to the extension of housing retention time and the increase in non listing numbers. The average stay time of properties in the market in October was 29 days, higher than the 28 days in September and the 23 days in October 2023. According to the sales speed, the available inventory is equivalent to 4.2 months of supply, which is slightly lower than the 4.3 months in September, but still far below the 6-month equilibrium level, and the overall supply is still relatively tight.4、 Industry insiders' suggestions for the market and buyers(1) Market trend analysisCompass broker Becco Zou pointed out that sellers have postponed their listing plans due to uncertainty about market trends, and are expected to relist next spring as it is the peak season for home purchases. NAR Chief Economist Lawrence Yin believes that the worst period of housing sales may have passed, and the increase in inventory will bring more transactions, job opportunities, and economic growth, which will lead to an increase in housing demand. However, for first-time homebuyers, mortgage loans are important, and although interest rates are high, they are expected to stabilize.(2) Buyer's purchasing adviceIndustry insiders have also provided purchasing advice for buyers. Ansari believes that buyers should adapt to the new normal of high interest rates, and can buy a house first. If interest rates are lowered, they can then raise funds to reduce costs. Otherwise, when interest rates are lowered, a large number of buyers will flood in or push up housing prices. Chen Hongming suggests that buyers should not delay their purchase decision due to waiting for changes in interest rates. Self owned housing can be purchased as early as possible, while investment housing should consider the return on investment. Becco Zou observed that first-time homebuyers still tend to purchase properties, while homebuyers tend to wait and see. Additionally, homebuyers are more picky about location and school districts, and in some areas, good properties need to be obtained through competition.The US real estate market is currently in a critical stage of development, with mortgage interest rates intertwined with current home sales trends, and loan application and supply volumes also changing. When making a purchase decision, buyers need to comprehensively consider market factors and their own situation, and the future trend of the market needs further observation and analysis.

2024-11-24View Details

Houston welcomes new opportunities to buy a house as interest rates fall

In the current economic situation, the decline in interest rates has brought new investment opportunities to the Houston real estate market. The following analysis will be conducted from several key aspects to help you fully understand the relevant situation and make wise investment decisions.1、 Houston Economic Growth and Employment Opportunities(1) Economic diversification patternHouston is the economic center of Texas, with a diversified economic structure. The energy industry holds an important position, with numerous energy giants forming a complete industrial chain here. The medical industry is well-developed, with well-known medical institutions and research centers. The rise of emerging industries in the field of technology has attracted many enterprises. The manufacturing industry has a profound foundation, covering various types of manufacturing.(2) Employment opportunities and population inflowDiversified economy brings abundant employment opportunities, where talents from various industries can showcase their talents. This attracts a large influx of people, including job seekers from other parts of the United States and international talent, laying the foundation for housing demand in the real estate market.2、 Houston Rental Market(1) Current situation of active leasing marketThe rental market in Houston is active, with young professionals and temporary immigrants as the main rental groups. Young professionals choose to rent houses due to career or economic reasons, while temporary immigrants rent houses due to their short stay. They have different needs for their living environment.(2) The advantages of investing in rental propertiesInvesting in rental properties is quite attractive. Multi family residential buildings, such as small apartment buildings, can accommodate multiple tenants, generate stable cash flow, and are easy to manage. Single household rental housing can meet tenants' privacy requirements, and those located near schools, medical centers, and employment centers are more likely to attract tenants.3、 Potential appreciation space for Houston real estate(1) Historical appreciation trendThe Texas real estate market has had long-term appreciation potential in history, and Houston is no exception. Over the past few years, with the development of cities, property prices have generally shown a steady upward trend.(2) Expected future appreciationIn the future, there is still significant potential for appreciation in the downtown area of Houston and its surrounding areas. There are many commercial activities and abundant resources in the city center, but housing supply is tight. The high-end suburbs have a good environment and complete supporting facilities. With population growth, housing prices in these areas are expected to rise, bringing opportunities for capital appreciation.4、 Types of properties suitable for investment in Houston(1) Single family residenceSingle family housing is suitable for investment, as it is close to schools, medical centers, and employment centers, which can attract tenants to earn rental income and have the potential for future appreciation, achieving dual benefits of rent and capital appreciation.(2) Multi family residenceMulti family residential buildings such as small apartment buildings are suitable for investors who pursue stable cash flow. By renting out each unit to earn rental income, professional companies can be hired to manage and reduce costs, and there is a basis for appreciation as the market develops.(3) Emerging communities and redevelopment zonesHouston's emerging communities and redevelopment areas such as the East Side have developed rapidly in recent years, with relatively low housing prices but great potential for appreciation. Early investment can obtain real estate at low cost, and the value can be significantly increased after regional development.5、 Prudent evaluation before investment(1) Rental level assessmentThe rental level is an important indicator of the profitability of real estate investment. Rent in different regions is influenced by various factors. Investors need to understand the market situation in the target area, analyze the average rent and fluctuation trend of different properties, in order to estimate the rental income after investment.(2) Trend analysis of housing pricesThe trend of housing prices is related to investment timing and returns. Investors need to understand the historical and future trends of housing prices in the target area, and can obtain information through consulting reports, intermediaries, or experts to determine investment feasibility.(3) Property tax considerationsProperty tax is an undeniable cost of real estate investment. Tax rates vary and may change in different regions. Investors need to understand the policies of the target region, calculate the annual amount to be paid, and consider its impact on investment returns.In short, there are many investment opportunities in the Houston real estate market when interest rates fall, but it is important to carefully evaluate key factors such as rental levels, housing price trends, and property taxes before making wise investment decisions.

2024-11-24View Details

Austin Life Guide: A Comprehensive Analysis of Chinese Communities and Housing Prices

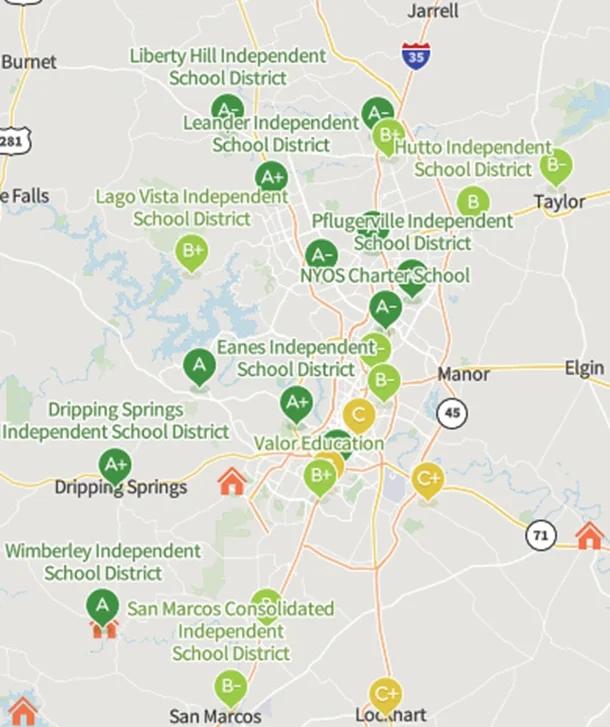

Austin, as the capital of Texas, has risen to prominence in the United States and even globally with its unique charm. It is known as the "Silicon Hill" and has become a thriving gathering place for high-tech enterprises. Many tech giants have set up camp here, and the entry of well-known companies such as Apple, Tesla, and Samsung not only injects strong economic vitality into the city, but also attracts countless talented people with dreams to gather here.According to PWC's 2024 Emerging Trends Report on the Real Estate Market, Austin's real estate market ranks among the top in the United States, reaching the fifth highest position. Behind this outstanding ranking is not only the strong driving force of urban economic development, but also the unique tax policy of Texas - no state tax. This advantage undoubtedly makes Austin an extremely attractive place to live, attracting people from all over the world to pursue new opportunities in life and career.Next, let's delve into the characteristics of different areas in Austin, especially the distribution of Chinese communities and housing prices, in order to provide more detailed references for those who intend to settle here.1、 Austin City CenterThe city center is undoubtedly the core heart area of Austin, where a wealth of impressive job opportunities converge. Various types of corporate headquarters and innovation research and development centers are scattered, providing broad opportunities for professional talents to showcase their abilities. At the same time, a variety of cultural activities are also staged here, ranging from various art exhibitions, concerts to theatrical performances, catering to the high-level needs of residents for spiritual and cultural life.And convenient living facilities are a major highlight of the city center. In modern shopping centers, renowned brands from around the world gather, making it easy to purchase both trendy clothing and high-end and exquisite daily necessities; Various restaurants offer delicious cuisine from around the world, ranging from authentic American dishes to exotic specialties, satisfying the discerning taste buds of different tastes; The convenient transportation network allows residents to easily shuttle between various corners of the city, whether it is public transportation or self driving travel, which is extremely convenient.However, such favorable conditions also result in high housing prices in the city center. But as the saying goes, 'you get what you pay for', the properties here are worth it both in terms of the scarcity of the location and the completeness of the surrounding facilities. For those who pursue high-quality urban life and hope to enjoy the core resources of the city up close, whether as a warm home for self occupation or as a potential asset for investment, the city center is undoubtedly an excellent choice.2、 Austin North SuburbsIn the northern suburbs of Austin, areas such as Round Rock, Georgetown, Cedar Park, Leander, and Liberty Hill have formed concentrated Chinese communities. There are many reasons why these areas are favored by Chinese people.Firstly, they are located close to numerous renowned technology companies. With the influx of tech giants such as Apple, Google, and Facebook, this place has become a gathering place for tech talents. For Chinese working in these enterprises, being able to live nearby can not only greatly shorten commuting time and reduce daily fatigue, but also better integrate into the local technology social circle and expand career development network resources.Secondly, the housing prices in the northern suburbs are relatively affordable, which is undoubtedly a major attraction for many people who want to settle down in Austin. Here, you can even find a new house priced at over 300000 yuan, which is undoubtedly a very rare opportunity for families with limited budgets but eager to have their own cozy nest or young people entering the workplace.Moreover, these Chinese communities have also formed a relatively complete living support system internally. There are supermarkets specifically designed for Chinese people, filled with specialty foods and daily necessities from all over China, allowing Chinese residents to taste the taste of their hometown and feel the warmth of home even if they are in a foreign land; There are also various Chinese schools, training institutions, etc. that provide a good educational environment for Chinese children, allowing them to inherit Chinese culture while also better adapting to the American education system.3、 Austin Eastern SuburbsHutto, Pflugerville, and Manor, as popular residential areas in the eastern suburbs of Austin, have gradually entered people's sight in recent years and attracted a lot of attention.This is the location where major technology and logistics companies such as Amazon and Tesla have established important facilities. With the establishment of Samsung's new factory and the development of Hutto Technology Park, employment opportunities in the region have sprung up like mushrooms after rain, injecting strong vitality into the local economy. This has also drawn the attention of many young families who are first-time homebuyers to this place.For these young families, the appeal of the eastern suburbs lies not only in the abundant employment opportunities. The living environment here is also very pleasant. The community planning is reasonable, the degree of greening is high, and public leisure facilities such as parks and leisure trails are readily available, providing residents with comfortable outdoor activity spaces, allowing them to enjoy leisure time with their families in their busy work.Meanwhile, housing prices are relatively in line with the economic affordability of young families. Although housing prices are gradually increasing with the development of the region, it still has a certain price advantage compared to areas such as the city center, allowing young families to achieve their dream of owning their own homes without bearing heavy economic pressure.4、 Austin West and Southwest SuburbsThe western and southwestern suburbs of Austin attract the attention of many high-end people with their unique charm. This place is renowned for its millions of mansions, magnificent natural landscapes, and top-notch educational resources.Among them, Eanes ISD, as one of the best school districts in Texas, is undoubtedly a major highlight of the region. Its excellent educational quality has cultivated countless outstanding students, who have shown outstanding performance in academic achievements, comprehensive quality cultivation, and other aspects. For parents who value their children's education, being able to provide education in such a school district is undoubtedly one of the most important factors they value.As a result, these two areas have attracted the construction of numerous high-end residential properties. These luxury homes not only have spacious living spaces and luxurious decoration styles, but are also equipped with high-end living facilities such as private swimming pools, gyms, gardens, etc., providing residents with the ultimate enjoyment of life.Moreover, the natural scenery here is also breathtaking. The vast forests, clear lakes, and continuous mountains form picturesque scenery, making residents feel like they are in a fairyland on earth. While enjoying a high-quality life, they can also have intimate contact with nature and relieve physical and mental exhaustion.5、 Austin South SuburbsBuda, Kyle, and San Marcos make up the popular residential areas in the southern suburbs of Austin. There are also many attractive features here.The relatively low housing prices are a major advantage of the southern suburbs. In San Marcos, one can even find new homes priced at over 200000 yuan, which is undoubtedly an attractive choice for budget conscious homebuyers.The I-35 highway runs through this area, closely connecting Austin and San Antonio, making it a convenient residential choice. Residents can easily travel between the two cities, whether it's for work, shopping, or leisure, which is extremely convenient.It is worth mentioning that Kyle ranked third among the fastest-growing cities in the United States in 2022. This data fully demonstrates the development potential of Kyle city and also indicates that the future development prospects of the southern suburbs are very broad. With the continuous influx of population, the infrastructure construction and commercial development here will also usher in new opportunities, and the quality of life of residents is expected to be further improved.Austin, a vibrant city, has unique charm and advantages in various areas. Whether it is the warm atmosphere of the Chinese community or the housing price choices in different price ranges, it provides rich and diverse living possibilities for people with different needs. I hope this comprehensive analysis can help you better understand Austin and make more suitable living decisions for yourself.

2024-11-24View Details

Houston, USA: A Charming Place for Real Estate Investment Opportunities

Houston, as a city full of vitality and opportunities, presents diverse and highly attractive investment projects in the real estate sector. Its abundant natural resources, prosperous industrial development, and complete living facilities have attracted much attention to new house and villa projects in various regions. The following will provide you with a detailed introduction to several new villa projects for sale in Houston.1、 New houses for sale in Houston:Lakeside Conroe Project(1) Project OverviewThe Lakeside Conroe project is located in Conroe, Montgomery County, north of Houston, and can be considered the backyard of Greater Houston. Its specific address is 9913 Crescent Cove Dr, Montgomery, TX 77356.The property information of this project is quite impressive. The unit covers 3/4 bedrooms, equipped with 2.5/3.5 bathrooms and 2 garages, with an area ranging from 220m ² to 223m ², priced at $340000 per unit.(2) Regional advantagesPopulation and Economy: Houston is one of the fastest growing cities in the United States, ranking ninth in population growth from 2010 to 2019, and even ranking first in population growth in 2016. The northern part of Houston where the project is located belongs to the white rich area, with a white proportion of 83.9% and an average household income of $80895. At the same time, there are over 7500 enterprises and nearly 100000 employees in the region, providing strong market demand and solid economic support for the real estate market.Natural Resources: The project is located adjacent to the largest pristine lake in northern Houston, 20000 acres of Lake Conlow, as well as millions of acres of pristine forest. The surrounding area is also home to Houston's best golf course and the largest theme park in the United States. Here, there are core high-quality natural resources, and residents can enjoy fresh air and beautiful environment to the fullest. In the morning, you can stroll by the lake facing the sunrise, breathing in super high negative oxygen ions to start a beautiful day; In the afternoon, you can reach 8 18 hole golf courses within 30 minutes, swing between mountains and waters, and enjoy the joy of life; On weekends, you can either leisurely float on thousands of acres of blue waves or fish and meditate, making it the preferred place to spend quality time with your family; If you want to immerse yourself in nature and release yourself, nearly a million acres of primitive forests are available for hiking, horseback riding, camping, or hunting, allowing you to have intimate contact with nature.Project scale and property rights: The Lakeside Conroe project has a total sales volume of 342 units, covering an area between 574 square meters and 1010 square meters, with a building area between 207 square meters and 225 square meters. The property forms include single family/row houses, with 3-bedroom+2.5 bathroom/4-bedroom+3.5 bathroom units, and has permanent property rights that can be borrowed, providing investors with stable and flexible investment choices.(3) Transportation locationThe project is about 14 miles away from the center of Conor and takes 20 minutes by car; About 24 miles and a 35 minute drive from Woodlands; 17 miles away from Conor North Houston Regional Airport, approximately 30 minutes; About 53 miles and an hour's drive from downtown Houston, heading south on Highway 45 provides direct access to downtown Houston; About 45 miles and a 50 minute drive from George Bush International Airport; About 58 miles and an hour's drive from Texas Medical Center. The convenient transportation network makes it easy for residents to travel and further enhances the location advantage of the project.2、New houses for sale in Houston: Pradera Oaks project(1) Project OverviewThe Pradera Oaks project is located in Bonney, Brazoria County, southern Houston, at 19302 Pradera Meadows Loop, Rosharon, TX 77583. The property provided by this project has a 3/4 bedroom layout, equipped with 2.5/3.5 bathrooms and 2 garages, with an area ranging from 192m ² to 204m ².(2) Project HighlightsIndustry and employment: The surrounding supporting facilities of the project area are mature, and there is great potential for future appreciation. The Houston Energy Port has as many as 15794 jobs, driving employment growth. At the same time, the world's largest medical center is also located nearby, with over 120000 direct job opportunities, providing ample employment opportunities for residents and making the area a valuable depression for Houston real estate. Major developers are rushing to register, with unlimited potential for appreciation.Living facilities: The project is located adjacent to Highway 288 and along Highway 99, which is currently under construction for Houston's Fourth Ring Road. It forms a 35 minute living circle and offers a wide range of shopping, dining, medical education, leisure and entertainment, sightseeing and vacation options. The newly built Manvel Town Center has officially opened, which is the largest open-air retail center in Houston, covering an area of 100000 square feet and currently introducing 76 shops. The population of over 76000 within a ten minute drive from the surrounding area has a median income of over 110000 US dollars, is 12.7 miles away from the project site, and is a 13 minute drive away. In addition, the surrounding area of the project is the best park in Texas, with about 18 parks of various sizes within a 20 minute drive. It is close to nature and has beautiful scenery, making it an excellent place for families to go on weekend vacations; The Houston Zoo will be upgraded and the Great Wolf Lodge water park resort will be within a 30 minute drive of the project, offering a wide range of leisure amenities.Real estate features: The Pradera Oaks project is a standalone, fully furnished, and ready to use property in the southern part of Houston. It is a model community for long-term rental villas, and investors can easily become worry free landlords. The project consists of 812 sets of fully furnished detached villas, covering a total area of approximately 1 million square meters. The property types include fully furnished detached villas, commercial properties, and apartments, with a building area ranging from 192 square meters to 204 square meters and a land area ranging from 427 square meters to 1073 square meters. The project also has permanent property rights and can be loaned, providing investors with high-quality real estate resources and investment conditions.(3) Transportation locationThe project is located in the southern part of Houston, approximately 33 miles from downtown Houston and a 35 minute drive away; About 30 miles and a 30 minute drive from Texas Medical Center; 28 miles away from Freeport, the largest deep-water port in the south, about 30 minutes; The project is approximately 11 miles away from Angleton, a 14 minute drive. Superior transportation location, convenient for residents' daily travel and communication with the outside world.3、New houses for sale in Houston: Crystal View at Lago Mar project(1) Project OverviewThe Crystal View at Lago Mar project is located in Galveston County, Texas, USA, at 12720 Flora Manor Dr, Santa Fe, TX 77510. The property has a 3/4 bedroom layout, equipped with 2.5/3.5 bathrooms and 2 garages. The area ranges from 200m ² to 224m ², and the price is $410000 per unit.(2) Project HighlightsUnique style and investment return: This project is the largest crystal lagoon community in Houston, where residents can enjoy Caribbean style without leaving their homes, with high investment return and great potential. Developers provide professional custody services, allowing investors to become worry free landlords, while also having sufficient employment security for renting and selling. With a concentration of enterprises and a stable tenant base, it provides a good economic benefit guarantee for real estate investment.Industry and employment support: The project is located in two major employment areas in the north and south of Houston, ensuring rental and sales, and attracting commuting tenants from the two central areas in the north and south of Houston. Galveston Island has three major industries for coordinated sustainable development, including the fourth largest cruise port in the United States (the largest port in Texas and one of the top ten cruise ports in the world, bringing in over $2.3 billion in economic impact annually, creating approximately 13890 job opportunities, and generating $869.6 million in revenue for Texas, with exponential growth in cruise travel), the tourism industry (receiving over 7 million tourists throughout the year, hosting more than 80 festivals, with an annual tourist consumption of $833 million, multiple historical sites, seaside beaches, and family attractions, with a 23.3% increase in tourism employment in the past 10 years), and a higher education institution (a renowned medical school, the origin of Texas medicine, the oldest medical school, a Level 1 trauma center, and training for one sixth of Texas physicians). Academic Center). In addition, as NASA's largest space research center, Johnson Space Center currently has over 3000 federal employees, along with employees from more than 60 main contractors signed with Johnson Space Center, bringing the total number of staff to 15000, providing a large number of job opportunities for the region.Project scale and location: The Crystal View at Lago Mar project covers an area of 37 acres and has a development volume of 176 standalone villas. The unit design includes a 3-bedroom, 2.5-bathroom, 2-car garage/4-bedroom, 3.5-bathroom, 2-car garage, with a building area of approximately 200-224 square meters and a land area of approximately 540-1420 square meters. The construction period is one year. The project is 13 miles away from NASA Space City, approximately an 18 minute drive; 21 miles from Galveston Island, approximately a 25 minute drive; 13.6 miles away from HCA Healthcare Medical Center, approximately a 17 minute drive; 31.5 miles from downtown Houston, approximately a 33 minute drive. Its unique geographical location occupies three of Houston's four major industries - aerospace, logistics, and healthcare. Within a 30 minute drive, it has 90000 jobs and a large tenant base, further enhancing the attractiveness of the project.These several new villa projects for sale in Houston, USA, each have their own characteristics. Whether it is abundant natural resources, prosperous industrial development, complete living facilities, or good investment return prospects, they provide highly attractive choices for investors and home buyers. Whether pursuing a comfortable living environment, stable investment returns, or convenient transportation, one can find the ideal choice that meets their own needs in Houston's real estate market.

2024-11-24View Details

In the decision-making process of purchasing real estate, school district factors are undoubtedly one of the crucial considerations. Recently, as the time for applying to private schools and taking exams for gifted classes in public schools approaches, many families often take this opportunity to plan their plans for buying and changing houses in the new year, in order to provide a better educational environment for their children.Today, BTRvillas, a technology real estate company, has carefully selected several areas worth considering when buying a school district house in Dallas based on Niche's "2024 Dallas Best Public School District" list, aiming to provide valuable information for those who are interested in purchasing a school district house in Dallas in the near future.It should be noted that the ranking of the school district in this article is based on authoritative evaluation by Niche, while the reference for housing prices covers all room types, and the relevant data is taken from the median housing prices calculated by Redfin in February 2024.Compared to last year, this year's "2024 Dallas Best Public School District" top ten list presents certain characteristics. Except for Argyle ISD, which made the list for the first time, the ranking order of other traditional old school districts has slightly fluctuated, but the overall change is not significant. Moreover, the distribution of school districts in the top ten list shows a diversified trend, with some belonging to high-income and high housing price areas, while others are located in suburban areas with relatively affordable housing prices. This provides a wide range of choices for choosing school district houses in Dallas at present.The following will provide a detailed and systematic introduction to the housing areas in various key school districts:1、 Southlake area(1) Regional Overview and Geographic LocationSouthlake and Grapevine are located northwest of Dallas, and they are adjacent to each other in an east-west direction. Carroll ISD and Grapevine Colleyville ISD, which belong to these two regions, respectively won first and second place in the "2024 Dallas Best Public School District" top ten list.Southlake is located about 20 miles from downtown Dallas and is home to a large number of high-income families, making it one of the top residential areas in the area. Correspondingly, its housing prices are also at a relatively high level, ranking first on the list with a median price of up to $1.38 million.(2) Analysis of Regional Advantages1. * * Solid Economic Foundation * *: Southlake has a solid economic foundation with many mature enterprises that not only provide stable and abundant employment opportunities for local residents, but also lay a solid foundation for the sustained prosperity of the regional economy.2. * * Comprehensive living facilities * *: The area is equipped with a rich variety of shopping centers, restaurants, and other commercial facilities. The streets are lined with green trees, creating an extremely convenient and livable living environment, fully meeting the diverse needs of residents for daily life and leisure entertainment.3. * * Excellent educational resources * *: Southlake's Carroll ISD stood out in the Greater Dallas Public School District, achieving first place and ranking third in the entire Texas school district rankings. The school district has 8389 students, with an ideal teacher-student ratio of 16:1, which means that each student can receive more comprehensive teacher attention and careful guidance, effectively ensuring the high-quality output of education and teaching.2、 Grapevine region(1) Regional Overview and Housing Price AdvantagesGrapevine borders the adjacent Southlake to the east, with a prime geographical location. It only takes a few minutes by car to reach Dallas Fort Worth International Airport, making transportation extremely convenient. Compared to Southlake, Grapevine's housing prices are significantly more affordable. According to the latest data, its median selling price is $569000, which is quite outstanding in terms of cost-effectiveness.(2) Analysis of Regional Advantages1. * * Convenient living facilities * *: The local area has numerous shopping areas, restaurants, art galleries, music venues, children's playgrounds, resorts and other diversified living facilities, which can fully meet the needs of residents in daily life, leisure and entertainment, and cultural and artistic aspects, presenting a good trend of convenience and livability.2. * * High quality educational resources * *: Grapevine's second place on the list is due to its outstanding educational resources. Grapevine Colleyville ISD performs excellently in key indicators such as student academic performance, teacher quality, and high school graduate enrollment. From relevant data and actual educational outcomes, there are almost no obvious shortcomings in the educational resources of local public schools, providing students with a high-quality and comprehensive educational environment and development conditions.3、 Allen Region(1) Regional Overview and Geographic LocationAllen is located in Collin County, 26 miles north of Dallas. The two school districts in the area, Allen ISD and Lovejoy ISD, ranked third and fifth respectively in the "2024 Dallas Best Public School District" top ten list, demonstrating strong educational capabilities.There are relatively many Allen ISD primary schools, but there is only one Allen High School in high school, which results in relatively concentrated educational resources and a considerable number of students, leading to significant competitive pressure faced by students in the learning process.(2) Analysis of Regional Advantages1. Comprehensive Development Education Concept and Achievements: Allen Campus adheres to the educational concept of encouraging children's comprehensive development and has achieved excellent results in various fields such as academia and sports. This feature has attracted many families who value their children's education to choose to settle here, aiming to create a better growth and education environment for their children and help them develop comprehensively.2. * * Good cost-effectiveness advantage * *: Recently, the median housing price in the Allen area has been around $480000, which is quite impressive in terms of cost-effectiveness. For families with relatively limited budgets but highly value educational resources, the Allen area is undoubtedly an attractive choice.4、 Coppell region(1) Regional Overview and Transportation AdvantagesCoppell has a superior geographical location and a well connected transportation network. It only takes 5 minutes to reach Frisco and Plano, and 10 minutes to reach the airport smoothly. Such convenient transportation conditions provide great convenience for residents' daily travel.(2) Analysis of Regional Advantages1. * * Beautiful living environment * *: This place has a beautiful and pleasant environment, and has won the first place in the Niche2023 ranking of the most livable cities in the Greater Dallas area, fully demonstrating its excellent quality in living environment and creating a comfortable and pleasant living atmosphere for residents.2. * * High quality educational resources * *: Coppell ISD ranks fourth in the Greater Dallas Public School District and seventh among the 1052 school districts in Texas. However, similar to the Allen school district, there is only one high school in the district, so the competition among students in terms of further education is relatively fierce.3. * * Active real estate market * *: Currently, the median housing price in Coppell area is around 593000 yuan, and its popular properties are sold on average within 15 days. This phenomenon fully demonstrates the fierce competition in the local real estate market, and also indirectly reflects the attractiveness of the area in many aspects, which is highly favored by home buyers.5、 Frisco region(1) Regional Overview and Economic DevelopmentFrisco is located 25 miles north of Dallas, where business is thriving, employment opportunities are rich and diverse, and the new Universal Studios theme park will soon be located here, which will undoubtedly further promote the vigorous development of the local economy, and greatly enhance the attraction and development potential of the region.(2) Analysis of Regional Advantages1. * * Excellent educational resources * *: Frisco ISD has grown in size over the past few decades with the continuous expansion and development of the region. Currently, it has 75 schools and a total of over 65000 students in the school district. In terms of academic performance, students at Frisco ISD perform exceptionally well, with an average SAT score of 1320 for high school graduates, which is significantly higher than the Texas and national averages, making Frisco ISD one of the most competitive and popular school districts in Texas, attracting a large number of students and families to settle and receive education here.2. Characteristics of properties suitable for large families: Currently, the median price of Frisco's houses is $642000, most of which are large single family houses. This type of house is more suitable for large families to live in and can fully meet the diverse needs of different family structures for living space.6、 Prosper Region(1) Regional Overview and Geographic LocationProsper borders Frisco to the north and boasts a beautiful environment with numerous parks and nature reserves, providing residents with a diverse range of outdoor activities to fully enjoy the beauty of nature and create a comfortable living atmosphere.(2) Analysis of Regional Advantages1. * * Diversified real estate options * *: In recent years, the Prosper area has developed some super large scenic real estate projects, providing a variety of layouts for buyers to choose from, which can fully meet the diverse needs of different buyers for housing layouts and living environments, and provide buyers with more abundant choices.2. * * High quality educational resources * *: Prosper ISD provides students with a rich and diverse curriculum system, covering STEM (Science, Technology, Engineering, and Mathematics), arts, sports, community service, and many other aspects of education and development. Students can freely choose different courses and learning methods based on their own interests and hobbies, laying a solid foundation for their future development and providing strong support for their comprehensive development.3. Analysis of housing prices: According to data from February 2024, the median housing price in the city is around $905000, which is higher than other areas in the northern suburbs of Dallas. However, considering its high-quality living environment, abundant educational resources, and diverse property options, it still has a certain appeal for homebuyers with corresponding economic strength and emphasis on comprehensive quality.In summary, the above-mentioned areas in Dallas have their own characteristics in terms of school district resources, living environment, housing prices, etc. Homebuyers can comprehensively consider various factors such as their own economic strength, family needs, and emphasis on educational resources to choose the most suitable school district housing area for themselves, providing strong guarantees for their children's education and family's quality of life.

2024-11-23View Details

The many actions of the world's richest man Elon Musk have always been closely watched, and recently his secret purchase of three luxury homes in Austin, Texas has sparked a lot of discussion. This matter not only involves the situation of the property itself, but is also closely related to various factors such as Musk's family planning, business considerations, and local environment. The relevant details and underlying reasons are worth exploring in depth.1、 Elon Musk's Property Purchase Overview(1) Real estate purchase situationAccording to news on October 30th, Elon Musk was recently revealed to have secretly purchased three luxury homes in Austin, Texas. According to informed sources, this purchase is mainly for his children and their mothers. Among these three properties, two are adjacent, and the third one is only a ten minute walk from the first two. The layout is relatively concentrated and seems to have the intention of creating a family courtyard.(2) Real estate specific informationOne of the luxury homes covers an area of 14400 square feet (approximately 1337.8 square meters), presenting a unique style similar to a Tuscan (Italian countryside style) villa. The other one is a six bedroom mansion, purchased with the assistance of Musk. The total value of these two properties is about 35 million US dollars, which seems insignificant compared to Musk's strong assets with a book value of 272 billion US dollars.The third mansion is speculated to be Musk's personal residence.2、 The family and business factors behind purchasing real estate(1) Family Planning IntentInsiders say that Musk has been committed to creating the concept of a 'big family'. He recently revealed to people around him that he hopes his dozen or so children and two of his mothers can live together, forming a family courtyard like living model, in order to create a family atmosphere and achieve the vision of family reunion.However, the reality is that among Musk's children, Neuralink executive Shivon Zilis has moved into one of the properties with her three children. But musician Grimes, as the mother of three other children, is competing with Musk for custody of the children. Moreover, Musk's first wife Justine Musk and her five children do not seem to have moved into these properties, and the family's occupancy situation is quite complicated.(2) Connection with businessThe plan for this family courtyard is not solely based on personal family considerations, but is closely related to the "survival anxiety" of Musk's business empire. Musk has his own obsession with birth rates and human reproduction, which may have influenced his decisions to create specific living environments for families to some extent, and may also have some inherent connection with his long-term business development plans.3、 Musk's political support behavior and related impactsMusk is not only busy in the business field, but also actively involved in political affairs. He runs almost six companies, but still finds time to support Trump and the Republican Party. It is reported that he even distributes $1 million daily to those who sign petitions supporting the First and Second Amendments, and directly donates $132 million to support Trump, demonstrating his political support.4、 Reasons and related information for choosing to buy a house in Austin(1) Geographical location factors of the companyThe primary reason why Musk chose to buy a house in Austin is that many of his companies are located in or near Austin. In fact, Musk has become one of Austin's largest employers. Austin is known as the "Silicon Mountain" due to its expanding technology industry, and in the eyes of some Californians, it is seen as a city that wants to become Silicon Valley. The development trend of the technology industry is good, which makes Austin extremely convenient for Musk in terms of geographical location.(2) Purchase price and special requirementsAlthough the average house price in Austin is about $526000, Musk clearly doesn't care about these price factors. According to insiders, Musk has offered some homeowners 20% to 70% higher than the market price, and his high bids are remarkable. Moreover, some homeowners are even required to sign a confidentiality agreement in order to view the quotation, making the purchasing process quite unique.5、 Zeng Youjian Family Courtyard Plan and Current SituationInsiders also revealed that Musk had planned to build a family compound on hundreds of acres of land near Tesla headquarters in the outskirts of Austin, which he and his company own. However, after an investigation by the federal government, this plan seems to have been halted. Previously, there were reports that federal prosecutors were investigating whether Tesla used company funds for a secret project described as the "CEO Residence," which may have been one of the reasons for the plan being halted.6、 Real estate occupancy and community situationIt is currently unclear which specific family members will ultimately live in these newly purchased properties. So far, only Hivon Zilis has been found living there. Neighbors said they can determine when Musk will visit because security measures will be significantly strengthened at that time. According to reports, the community where Musk purchased the property is densely populated and lacks access control facilities, and the community environment and occupancy situation exhibit certain characteristics.The purchase of property by Musk in Austin involves various factors and circumstances, with intertwined considerations of family, business, politics, and other factors. The future use of these properties and the development of related situations still need further observation.new homes for sale in houston:The Barracks

2024-11-23View Details