Industry ResearchNews

As an important source of fiscal revenue, the US property tax is regulated by state and local governments, and the tax rate varies significantly depending on the local setting, based on the assessed value of the property. This article introduces the average property tax rates in typical states such as New Jersey, Illinois, Texas, and California, and points out that specific city and county tax rates may be adjusted. It also explains that property taxes are used for public services, emphasizing their impact on homeowner finances and community development. It reminds homebuyers or residents of the importance of understanding local tax rates for home purchases and financial planning.The property tax in the United States occupies an important position in its fiscal system, and its regulations exhibit diverse characteristics due to differences in state and local governments. There are significant regional differences in tax rates, and their applications are widely involved in the public service sector. The relevant situation is crucial for the group considering buying a house in the United States, which will be elaborated in detail below.1、 Basic regulations of US property tax(1) Set subject and tax rate differencesIn the United States, property tax is one of the important sources of fiscal revenue, and its specific regulations are mainly controlled by state and local governments. Among them, property tax rates are usually set by local governments, which may result in significant differences in property tax rates in different regions of the United States.(2) Fundamentals of CalculationThe calculation basis for property tax is the assessed value of the property. Every year, local governments conduct specialized assessments of properties with the aim of accurately determining their market value. Subsequently, based on the set tax rate, the property tax payable is calculated accordingly. The tax rate here is generally presented in percentage form, commonly such as 1% or 2%.2、 Typical State Property Tax RatesHere is an overview of property tax rates in several typical states in the United States for a more intuitive understanding of regional differences:(1) New JerseyThe average property tax rate in New Jersey is 2.47%, which is relatively high among all states.(2) Illinois StateThe average property tax rate in Illinois is 2.27%, which is also a relatively high tax rate range.(3) Texas StateThe average property tax rate in Texas is 1.80%, but it should be noted that this is only the average data at the state level. In practical situations, tax rates may be adjusted for each county or city in the state. For example, in some cities in Texas, property tax rates may even reach as high as 3%, a significant increase compared to the state average tax rate.(4) California StateThe average property tax rate in California is relatively low, at 0.79%.3、 The purpose and impact of property tax(1) Scope of useThe use of property tax is quite extensive, usually covering the support of many important public service areas in the local area, such as supporting the development of local education, providing financial support for school construction, faculty deployment, etc; Used to maintain public safety, including police law enforcement, fire protection equipment, and other aspects; It is also used for infrastructure maintenance, such as road repairs, updates to public facilities, etc.(2) Impact on homeowners and communitiesThe level of property tax not only directly affects the personal financial situation of homeowners, but also increases or decreases their economic expenses based on the amount paid. At the same time, property tax indirectly affects the overall development of the community and the quality of life of residents. For example, sufficient property tax revenue can ensure that schools in the community have good teaching conditions, complete public safety facilities, and normal infrastructure maintenance, thereby improving the overall quality of life and development potential of the community.4、 Suggestions for homebuyers or residentsFor investors or residents who are considering buying a house in the United States, it is extremely important to have a deep understanding of the local property tax rates. This is because the high or low property tax rate is related to the initial cost of purchasing a house, as a higher tax rate means that additional property taxes need to be paid, increasing the overall cost of purchasing a house; It also involves long-term financial planning. Before making a purchasing decision, it is strongly recommended to consult the local tax department in detail. They can provide the most accurate tax information or hire professional financial advisors to provide professional planning advice, so that reasonable planning and arrangements can be made in terms of property investment and living costs.In summary, property tax rates in the United States vary by region, which requires homebuyers or investors to fully consider tax costs when making relevant decisions. Accurately understanding and reasonably estimating these tax costs is of great significance for scientifically planning real estate investments and effectively controlling living costs.

2024-11-23View Details

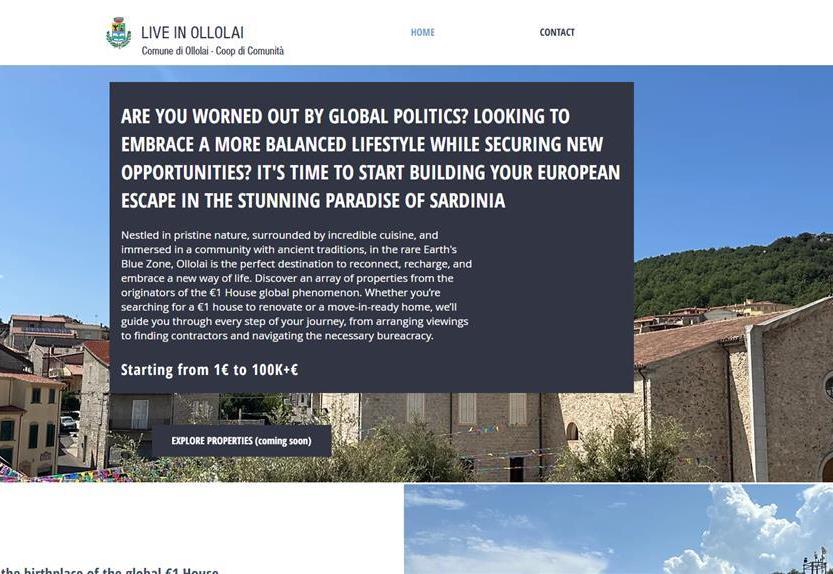

Olole Village, Sardinia, Italy, launched the event of selling dilapidated houses at a price as low as 1 euro to attract potential immigrants from the United States when Trump was elected as the President of the United States, which triggered some Americans to consider leaving the United States. It introduced a variety of accommodation options it provided and a large number of applications received from the United States. At the same time, it mentioned that the Italian "1 euro house" plan was being implemented in many places. The Sicilian case showed that the actual purchase of such houses was more than 1 euro and there were additional requirements. It also described the economic vitality and industrial development promotion effect of the plan on the local economy. The article involves data such as 38000 housing applications received in Olole Village, the cost of purchasing a house in Taborn, and a 3000% increase in tourism revenue in Musomeli Town.In response to population and other related issues, some regions in Italy have launched distinctive housing sales programs. Especially during the recent US election results that have caused many reactions, the village of Olole in Sardinia has taken this opportunity to take action and attract potential immigrants from the United States. The relevant situation and its underlying impact are worth exploring in depth.1、 The measures taken by Olole Village to attract potential immigrants from the United States(1) Background and OpportunityAccording to a report by CNN cited by Global Times on the 19th, Trump is about to take office as the President of the United States, which has caused many opponents of Trump to feel low and even consider leaving the country. The village of Olole in Sardinia, Italy, has keenly captured the business opportunities hidden in this sentiment and is attempting to revive the village by attracting potential immigrants amidst global discussions about the US election results.(2) Specific methodsOlole Village has launched a website specifically targeting potential American immigrants and advertised "European Refuge", offering a variety of affordable housing options. Francesco Columbus, the village head, said he firmly believed that Americans were the "best choice" to help the village revitalize.The village provides three accommodation options for potential immigrants: one is free temporary housing; The second is a 1 euro house that needs renovation; The third is a ready-made housing worth 100000 euros. Columbus also mentioned that the website has received 38000 housing applications, most of which are from the United States. Moreover, the village has arranged a dedicated team to guide potential buyers through the various steps of purchasing a house, and vacant properties will also be launched on the website as soon as possible.(3) Explanation of the original intention of the planColumbus emphasized that this plan is not targeted at any specific political leader, but rather aims to meet the relocation needs that some people may have after the US election.2、 Overview of Italy's "1 Euro House" PlanIn fact, Italy has been implementing the "1 Euro House" plan in the past few years, aiming to attract more population to rural areas and revitalize the regional economy. Numerous Italian towns have participated in the project, with 74 towns already involved so far, covering almost the entire map of Italy, including popular tourist destinations such as Mussomelli on the island of Sicily.3、 Actual purchase situation and case of "1 Euro house"(1) Actual purchase requirementsAccording to the exchange rate, 1 euro is equivalent to approximately 7.6 Chinese yuan. However, to truly live in these so-called "1 euro" old houses, the cost is not limited to this. 1 euro is only a symbolic starting price. In the actual purchasing process, different towns have additional requirements for buyers, and it is generally stipulated that buyers need to complete the renovation of the house within a certain period of time (usually three years) after purchasing.(2) Specific casesTaking 44 year old Chicago resident Meredith Tabern as an example, she participated in the "One Euro Auction Project" in Sambuka, Sicily in 2019. She initially bought a property for 5555 euros, plus taxes and other fees, and ultimately spent 5900 euros. At that time, the purchased house had no electricity, no running water, and there was pigeon excrement with a diameter of half a meter on the floor.Later, she bought the neighboring house for 22000 euros in a private auction, and although the total area of the house expanded, the decoration cost also increased significantly. After adding the decoration cost, she spent a total of 425000 euros, approximately 3.356 million yuan.4、 The impact of the "1 Euro House" plan on the local areaAlthough the actual cost of purchasing such houses is high, overall, the plan has indeed brought many positive impacts to small towns in Sicily, Italy.For example, the demand for home renovation and decoration has created a large number of new jobs for the local construction industry. The arrival of new residents has promoted business in the local catering and hotel industries, and also ignited the tourism industry. As stated by Nigrelli, the deputy mayor of Musomelli town in Sicily, since the launch of the "One Euro House Sale" plan, Musomelli's tourism revenue has increased by 3000%.The "1 Euro House" plan in Italy presents a unique situation and impact, both from the perspective of attracting immigrants and on local economic development, and deserves continuous attention to its future development trend.

2024-11-23View Details

Can Trump fill the US housing market with his policies after being elected

The current situation and future trend of the US real estate market are discussed, pointing out that the inventory of US real estate is far below the 6-month equilibrium point, and the average housing price has repeatedly hit new highs (up 4.2% year-on-year in August, with even higher increases in some cities). The reasons for the continuous rise in housing prices and the impact of the Federal Reserve's interest rate cuts are analyzed. At the same time, the complex impact of Trump's related ideas (such as urging the Federal Reserve to cut interest rates, deporting illegal immigrants, raising tariffs, etc.) on the US real estate market after his election as president was explored, including possible inflation, housing construction difficulties, and different views and expectations from various parties in the market.The development trend of the US real estate market has always been closely monitored, and many factors are intertwined to influence its direction. Currently, there is a situation where the inventory of real estate is far below the 6-month equilibrium point, while the average housing price continues to rise and repeatedly reaches new highs. There are various presentations and interpretations of relevant data and viewpoints from various parties.1、 Current situation of the US real estate market(1) Inventory and housing price situationAccording to the latest information, the inventory of real estate in the United States is currently only 3 to 4 months of sales volume, which is far below the 6-month equilibrium point, indicating a relatively tight supply of real estate.At the same time, the data on housing prices is also quite remarkable. According to the latest S&P Case Shiller Index released recently, the average housing price in the United States increased by 4.2% year-on-year in August, reaching a new historical high. Among them, the year-on-year increase in housing prices in New York, Las Vegas, and Chicago ranks among the top 20 cities covered by the index, reaching 8.1%, 7.3%, and 7.2% respectively. Other major cities such as Detroit, Los Angeles, San Diego, etc. have also shown varying degrees of rising housing prices, with different specific increases.(2) Analysis of the reasons for the rise in housing pricesChen Yuewu, Executive Partner of Golden Eagle Real Estate Investment Company in the United States, pointed out that the shortage of supply in the US real estate market is the fundamental reason for the continuous rise in housing prices. Major authoritative institutions in the United States have also made relevant estimates, with estimates from Fannie Mae and Freddie Mac showing a housing shortage of around 4 million units. This supply-demand imbalance is driving up housing prices.2、 The impact of the Federal Reserve's interest rate cuts on the real estate market(1) Interest rate cuts and trends in mortgage interest ratesAs the Federal Reserve begins its interest rate cut cycle, this measure has had a significant impact on the US housing market. The Federal Reserve significantly cut interest rates by 0.5 percentage points in September this year, officially beginning its interest rate cutting cycle. On November 7th, it cut interest rates by another 0.25 percentage points. Recent data shows that the inflation rate in the United States has dropped to 2.4%, basically meeting the Federal Reserve's target, and the labor market is rapidly cooling down.In this context, mortgage interest rates have entered a downward trend. In mid September, the US mortgage interest rate dropped significantly from 7% to around 6.1%. Although it has rebounded to 6.79%, the downward trend has not changed. The market expects the Federal Reserve to continue cutting interest rates by about 1 percentage point in 2025, with the final rate dropping to 3.75% to 4%. Industry insiders such as Chen Yuewu predict that by 2025, US mortgage rates will fall to the range of 5% to 6%.(2) Positive impact on the real estate marketThe downward trend in mortgage interest rates is a significant positive for the US housing market. With the continuous decline in mortgage interest rates, the demand for real estate will be greatly released, and it is expected that the rise in housing prices will accelerate again, with the growth rate expected to return to over 10% in the future.3、 The impact of Trump's related ideas on the US real estate market(1) Urge the Federal Reserve to cut interest rates and its possibilityTrump has repeatedly proposed in the 2025 US presidential election to urge the Federal Reserve to significantly lower interest rates and to address the housing burden in the United States by promoting new home construction. US real estate tycoon and CEO of Cardon Capital, Gakadon, believes that Trump's return to the White House will lead to a significant interest rate cut by the Federal Reserve. He believes that there is a huge real estate problem in the United States, and only by exerting tremendous pressure on the Fed to cut interest rates can it be alleviated. He also believes that Trump can achieve this, and even predicts a historic interest rate cut in the next 12 months, bringing US mortgage rates down to 4% or lower.However, Federal Reserve Chairman Powell has repeatedly stated his intention to maintain independence from the executive branch. Even if Trump wins the election, Powell stated at a press conference that if Trump demands his resignation, he will refuse because US law does not allow the president to dismiss the Federal Reserve chairman. Moreover, Professor Hu Jie pointed out that Powell's term will not expire until 2025, and the new president will not immediately affect the leadership of the Federal Reserve. In addition, the seven members of the Federal Reserve change every two years, and each change requires nomination by the president and approval by the Senate. The operation of the 12 local Federal Reserve banks is also completely independent of the president's jurisdiction, and the executive branch's ability to directly intervene in financial policies is quite limited.(2) Other ideas and interference with the real estate marketSome of Trump's other ideas may disrupt the real estate market. On the one hand, his idea of significantly reducing taxes and raising tariffs may stimulate inflation. According to Professor Hu Jie's explanation, unless there are significant unexpected fluctuations in data such as inflation, gross domestic product (GDP) growth, or unemployment rate in the United States, the Federal Reserve should steadily lower interest rates according to the established pace. If there are unexpected situations, the pace of interest rate cuts will be adjusted accordingly.On the other hand, Trump has vowed to deport a large number of illegal immigrants. According to Chen Yuewu, as about one-third of the construction industry's labor force comes from illegal immigrants, this move may cause a significant loss of labor and lead to a shortage of labor in the construction industry. As workers decrease, wages may rise, which may then be passed on to homebuyers through rising housing prices. At the same time, Trump has vowed to significantly increase tariffs. Experts have stated that imposing tariffs of 10% to 20% on building materials such as wood may push up housing costs and the cost of home decoration materials. Any tariffs that increase product costs will directly affect consumers.(3) The views and expectations of all parties in the marketThere are different opinions and expectations in the market regarding the direction of the US real estate market after Trump's election. Chen Yuewu stated that the current market view is that with Trump's victory, Wall Street investors are beginning to bet on rising inflation and reduced interest rate cuts. In the short term, due to continued tight supply, housing prices may continue to rise, and fluctuations in mortgage interest rates are expected to make both buyers and sellers cautious. In the long run, the situation may become better or worse, depending on what Trump decides to prioritize after entering the White House.The US real estate market is showing a complex development trend under the combined effects of inventory, housing prices, Federal Reserve policies, and Trump's related ideas. Its future trend still needs to be continuously monitored in order to accurately grasp market changes.

2024-11-23View Details

The reason for the largest increase in sales of second-hand homes in the United States in October since earlier this year (up 3.4% month on month to 3.96 million units at an annual rate) is that buyers seized the opportunity of the decline in mortgage interest rates in the previous month. At the same time, it is pointed out that although sales have increased, the housing market is facing difficulties due to the fluctuation of mortgage interest rates (currently approaching 7%), limited inventory (the inventory of unsold houses in October increased slightly by 0.7% to 1.37 million units, far below pre pandemic levels), and the tight inventory has led to high housing prices (the median selling price in October increased by 4% year-on-year, setting a record for the highest October in history), as well as related economic factors and industry insiders' views.The dynamics of the US real estate market have always been closely monitored, especially the performance of the second-hand housing market, which can largely reflect various aspects of the economic situation and market supply and demand. As of October 2024, the US second-hand housing market presents a series of characteristics and trends, and the relevant data and influencing factors are of great analytical value.1、 The growth trend and reasons for the sales of second-hand houses in the United States in October(1) Sales data presentationThe data released by the National Association of Realtors (NAR) on Thursday clearly shows the sales of the US second-hand housing market in October. According to statistics, the sales volume of second-hand houses increased by 3.4% month on month, which is equivalent to an annual rate of 3.96 million units. This data exactly matches the median estimate of economists surveyed by Bloomberg, indicating that the sales growth is within the expected market range and has a certain degree of rationality and representativeness.(2) Reasons for sales growthThe key to the largest increase in second-hand housing sales since earlier this year in October is that buyers accurately captured the favorable opportunity brought by the decrease in mortgage interest rates in the previous month. When there was a downward trend in mortgage interest rates in the previous month, it meant that the cost of purchasing a house was expected to decrease for potential buyers, greatly stimulating their desire to buy a house. Many buyers took this opportunity to sign purchase contracts and successfully completed transactions in October, which greatly boosted the significant increase in second-hand housing sales that month.2、 Analysis of the Challenges Faced by the Housing Market(1) The impact of fluctuations in mortgage interest ratesDespite the upward trend in second-hand housing sales in October, the overall housing market in the United States is still deeply mired in difficulties, with the fluctuation of mortgage interest rates posing a significant obstacle.Looking back to September, mortgage interest rates fell to their lowest point in two years, prompting a large number of buyers to seize the opportunity to sign purchase contracts and complete property transactions the following month (i.e. October). This was an important factor driving the growth of second-hand housing sales in October. However, with the passage of time, the current cost of housing financing has approached a high of 7%. This change is mainly attributed to the combined impact of strong economic data and factors such as Trump's victory in the election. These factors are intertwined, leading to a significant weakening of market expectations for the Fed's interest rate cuts in the coming months, which in turn causes mortgage rates to rise to high levels again and show an unstable fluctuation state. This situation undoubtedly brings many uncertainties to the housing market, not only increasing the economic burden on homebuyers, but also making them face greater difficulties in the process of purchasing a house.(2) The constraint of limited inventoryIn addition to fluctuations in mortgage interest rates, another severe challenge facing the housing market is limited inventory. At present, the high borrowing costs have directly led to a shortage of supply in the second-hand housing market.Many potential sellers, due to their already locked in low interest rate advantages, are often unwilling to easily list their properties for sale. Because once they choose to sell their property, they are highly likely to face higher borrowing costs when purchasing a new property. Therefore, from the perspective of balancing economic benefits, they are more inclined to maintain their current property ownership status.However, as the market situation gradually evolves, more and more homeowners are beginning to accept mortgage interest rates of around 6-7% as a new norm and are willing to push their homes into the market for transactions. Nevertheless, based on specific data, the inventory of unsold houses in October only slightly increased by 0.7%, reaching a scale of 1.37 million units. Although inventory has shown a certain upward trend, there is still a huge gap compared to the pre pandemic housing inventory level, far lower than the inventory quantity at that time. This fully indicates that the tight inventory situation has not been substantially improved and still poses a serious constraint on the healthy development of the housing market.3、 The situation and reasons for the high housing pricesUnder the dual impact of relatively weak sales and tight inventory, housing prices in the United States remained at a high level in October. According to the NAR report, the median selling price of second-hand homes increased by 4% year-on-year in that month, reaching a level of $407200, successfully setting a record for the highest price in October in previous years.The factor of tight inventory has largely led to a very limited number of houses available for selection in the market, thus forming a seller's market pattern to a certain extent. In this market environment, sellers have a relative advantage in housing pricing and are able to set higher prices more autonomously, which in turn drives the continuous rise of housing prices. Even in the context of overall sales not being very strong, housing prices can still maintain a high price level thanks to the seller's market advantage brought about by tight inventory.The second-hand housing market in the United States showed an increase in sales in October, but the housing market still faces many difficulties, as well as a complex situation of high housing prices. These situations are intertwined and fully reflect the characteristics and challenges of the real estate market in the current economic environment in the United States. It is necessary to continue to pay attention to its subsequent development trend in order to more accurately grasp the direction of the real estate market.

2024-11-22View Details

The real estate market situation in the United States has always been a concern, and recently there have been many changes and trends in the construction of single family homes, reflecting the complex situation faced by the market. This will be elaborated in detail below.1、 The decline in the construction of single family homes in the United States in October(1) Specific data presentationAccording to data released by the US Department of Commerce on Tuesday, the construction of single family homes, which account for a significant proportion of housing construction, saw a significant decline last month. According to the seasonally adjusted annualized rate, the number of single family housing starts in October decreased by 6.9% to 970000 households. After the data for September was revised upwards, it showed that the number of houses built increased from the previously announced 1.027 million to 1.042 million, indicating the significant decline in the number of single family homes built in October.(2) Analysis of influencing factorsThe factors that led to a significant decline in the construction of single family homes in October are multifaceted.Firstly, in terms of natural factors, hurricanes Helen and Milton had a suppressive effect on related activities in the southern United States. The arrival of these hurricanes has disrupted the normal construction process in the area, making it difficult for construction projects to proceed as planned, thereby affecting the number of single family homes being built.Secondly, at the economic level, the increase in mortgage interest rates has a significant impact on it. Despite a slight increase in construction permits, the rise in mortgage interest rates has led to higher borrowing costs for builders and homebuyers. This not only increases the pressure on homebuyers to purchase houses, leading to a suppression of potential housing demand, but also makes builders more cautious when carrying out new projects, increasing financial pressure and limiting the construction scale of single family homes, resulting in a significant decline in the number of constructions.Furthermore, in terms of overall housing supply, the current supply of new housing in the United States is at a low level since 2008. The shortage of housing supply to some extent reflects the imbalance between supply and demand in the market, and further restricts the growth of the number of single family residential buildings constructed. Due to the tight housing supply, builders may face a series of problems such as insufficient raw material supply and rising labor costs, which are not conducive to the progress of single family residential construction projects.2、 Relevant information on mortgage loan interest rates(1) Changes in interest rate trendsAs the Federal Reserve began cutting interest rates in September, mortgage rates initially decreased, which gave the market a glimmer of hope and seemed to ease the pressure of buying and building houses. However, the subsequent situation changed. Given the strong economic data in the United States and concerns that President elect Trump's policies, including tariffs on imported goods and large-scale deportation of immigrants, may reignite inflation, mortgage rates have erased their previous decline and returned to higher levels.(2) Relation with treasury bond bond yieldThe yield of the benchmark 10-year US treasury bond bond also showed significant changes during this period, having risen to the highest point in five and a half months, and remained at the same level in the follow-up. It is worth noting that the mortgage interest rate is highly consistent with the yield of 10-year treasury bond. This means that the fluctuation of treasury bond yield will directly affect the mortgage interest rate, and then have a chain reaction on the real estate market, affecting the purchase decision of buyers and the construction plan of builders.3、 Confidence Index of Housing BuildersAlthough a survey released by the National Association of Home Builders on Monday showed that the confidence index of home builders rose to a seven month high in November, there are specific reasons behind this situation. The increase in confidence index this time is mainly due to builders' increasing belief that after the Republican Party gains all power in Washington, the regulatory pressure on the industry will be significantly reduced. That is to say, the expected improvement of the regulatory environment for the future industry by builders has boosted their confidence in the current situation, but this does not mean that the many practical problems facing the real estate market, such as the decline in construction quantity, insufficient housing supply, and high mortgage interest rates, have been solved.The decline in the number of single family homes built in the United States in October and the combined impact of related market factors fully demonstrate the complex and severe situation currently faced by the US housing market. It is necessary to continue to monitor its subsequent development trend and changes in various factors in order to better grasp the direction of the US real estate market.

2024-11-21View Details

The dilemma of the US housing market: why are homebuyers getting older?

This article focuses on the many challenges facing the US housing market, analyzing the high housing prices and insufficient supply reflected by the increasing average age of homebuyers. It elaborates on the complex impact of factors such as the Federal Reserve's interest rate hike policy, rising construction costs, and differences in housing policies between the two parties on the housing market. It emphasizes that alleviating housing pressure requires a balance between controlling inflation, promoting economic growth, and driving housing supply growth. It also explores the measures that future policy makers can take to solve housing problems and the necessity of multi-party collaboration.The current situation in the US housing market is severe and complex, facing a series of intertwined challenges that not only affect the healthy development of the real estate market, but also concern the vital interests of many homebuyers. The following will provide a detailed explanation of the relevant situation.1、 The difficulties and influencing factors facing the US housing market(1) The market situation behind the age change of homebuyersRecently, the US housing market has shown a significant feature, with the average age of homebuyers rising to 56 years old. This phenomenon is not accidental, and it deeply reflects two prominent problems in the US housing market: high housing prices and insufficient housing supply.From the perspective of housing prices, their upward trend is evident. According to data from September 2023, the median selling price of homes in the United States has reached $427000, an increase of 3.8% compared to the same period last year. Such high housing prices have put enormous financial pressure on many potential homebuyers, especially young people with relatively weak economic strength, and have to postpone their home purchase plans.From the perspective of housing supply, the supply-demand imbalance in the US housing market is quite severe. It is estimated that the supply gap is about 4.5 million housing units. The severe shortage of housing supply, coupled with high housing prices, further exacerbates the difficulty of purchasing a house, which is also one of the important factors leading to an increase in the average age of homebuyers.(2) The impact of the Federal Reserve's interest rate hike policyThe Fed's interest rate hike policy has had significant impacts on the US housing market in multiple ways, further exacerbating market difficulties.On the one hand, interest rate hikes have led to an increase in mortgage rates. The Federal Reserve has taken interest rate hikes to combat high inflation, which has directly led to a surge in mortgage rates. For homebuyers, the increase in mortgage interest rates means a significant increase in the cost of purchasing a house, particularly affecting low - and middle-income families. Their burden of purchasing a house has significantly increased, making it increasingly difficult to implement their housing plans.On the other hand, the interest rate hike policy has indirectly affected builders. As financing costs rise due to interest rate hikes, builders are facing the dilemma of continuously increasing construction costs for new homes. This not only increases the operational pressure on builders, but also hinders the increase of housing supply, further exacerbating the supply-demand imbalance in the housing market.(3) The pressure of rising construction costsThe rise in construction costs is also one of the important factors troubling the US housing market.In the current economic environment, trade protectionism policies have led to an increase in the cost of building materials, and the financing costs for builders are also rising. The combined effect of the two has led to a continuous increase in the cost of building new houses, which undoubtedly has a negative impact on housing supply, exacerbating the situation of insufficient housing supply and driving up high housing prices.(4) Obstacles to the housing policy differences between the two partiesAt the political level, the differences between the Democratic Party and the Republican Party on housing policies have added a lot of complexity to the solution of the US housing market problem.The Democratic Party advocates increasing housing supply through government intervention, but this approach faces many difficulties and complexities in implementation, and the actual effect often fails to meet expectations, making it difficult to effectively alleviate the shortage of housing supply.The Republican Party's market mechanism reform plan, although aimed at solving the housing supply problem from a market perspective, has little effect in the short term and is difficult to significantly improve the supply-demand imbalance in the housing market in a short period of time.The divergence in housing policies between the two parties has made it difficult to effectively address the key issue of increasing housing supply, resulting in a fundamental alleviation of the overall difficulties in the US housing market.2、 Strategies and measures to alleviate pressure on the US housing marketGiven the severe challenges faced by the US housing market, in order to promote its healthy development and alleviate market pressure, it is necessary to formulate strategies and take corresponding measures from multiple aspects.(1) Balancing macroeconomic regulation objectivesThe key to alleviating the pressure on the housing market lies in achieving a balance between controlling inflation and promoting economic growth.Controlling inflation can maintain price stability, avoid excessive economic fluctuations, and create a relatively stable macroeconomic environment for the housing market. At the same time, promoting economic growth can increase residents' income levels, enhance their ability to purchase houses, and provide strong support for the development of the housing market. Only by achieving a balance between these two aspects can a solid foundation be laid for the stable development of the housing market.(2) Promote the growth of housing supplyIt is crucial to promote the growth of housing supply while ensuring the stability of the macroeconomic environment.The increase in housing supply can help alleviate the imbalance between supply and demand, reduce the pressure of housing competition, and promote the return of housing prices to a reasonable range, providing more choices for homebuyers and achieving a virtuous cycle in the housing market. Therefore, promoting the growth of housing supply should be regarded as one of the important measures to alleviate the pressure on the housing market.(3) Specific measures and collaborative requirementsTo achieve the above goals, the government can take a series of specific measures, and the effective implementation of these measures requires close cooperation between federal and local governments.Firstly, expedite the approval process. By simplifying and optimizing the approval process for housing construction projects, the efficiency of approval can be improved, and more housing construction projects can be implemented as soon as possible, thereby effectively increasing the speed of housing supply and alleviating the current situation of housing supply shortage.Secondly, guide more private capital to enter the market. The government can introduce relevant preferential policies, such as tax reductions, fiscal subsidies, etc., to encourage and guide private capital to invest in the field of housing construction, provide sufficient financial support for housing construction, and help increase housing supply.Furthermore, provide housing subsidies or preferential loans to low - and middle-income families. Considering the economic difficulties faced by low - and middle-income families in the process of purchasing a house, providing such subsidies or loans can alleviate their housing burden, enhance their purchasing ability, and promote the balance of supply and demand in the housing market.However, it should be clarified that the effective implementation of these measures cannot be achieved by one party alone, and requires close cooperation between federal and local governments to form a synergistic effect. Only through joint efforts from multiple parties can we find long-term and effective solutions, gradually alleviate the severe difficulties faced by the US housing market, and promote the healthy and stable development of the US housing market.The problems in the US housing market are complex and intricate, and solving these problems requires all parties to uphold a spirit of cooperation, from macroeconomic regulation to specific policy implementation, and work together at multiple levels to achieve the healthy development of the housing market.

2024-11-21View Details

How to choose high cost-effective housing? Four major advantages of American real estate

In the past two years, many Chinese real estate investors have turned their attention to investing in American real estate. American real estate investment has four major advantages, including permanent property rights, price advantages, optimal investment timing, and comprehensive policy and legal protection. Finally, a highly cost-effective Sonata Estates real estate project in Dallas was recommended, showcasing its characteristics and advantages from project highlights, introduction, information, and location, helping readers comprehensively understand the relevant situation of American real estate investment Hey, friends! In the past two years, many Chinese real estate investors have turned their investment focus to the United States, and many have already started investing in American real estate. Do you really understand the advantages of real estate investment in the United States? Today, let's take a good look with Xiaomei. 1、 The advantages of real estate investment in the United States Advantage 1: Permanent Property RightsThe property rights in the United States are privately owned, and they are perpetual property rights! Once you buy a house, it's not just the house that belongs to you, even the sky above the house and the land below it will always be yours, and the property rights are stable. Advantage 2: Price advantageNowadays, the average median price of all houses in the United States is actually not high, which means that half of the property prices are in a relatively low price range. If we look at this price in many cities in China, it really looks very approachable. And, at the same price, buying a house in the United States with an area more than three times larger than buying one in China, doesn't it feel very cost-effective? Advantage 3: Good investment timingFrom the decades long housing market situation in the United States, it can be seen that housing prices have undergone cyclical changes, with a cycle of approximately 10-12 years. After the decline of the US housing market from 2006 to early 2012, the housing prices in the United States are currently in a stable period. Friends who understand investment can see that in the next 5 to 6 years, US housing prices will continue to steadily rise. Therefore, now is the best time to invest in US real estate, don't miss it! ###Advantage 4: Comprehensive policy and legal protectionThe real estate laws in the United States have undergone decades of development and improvement, gradually forming a relatively complete and mature real estate legal system and market environment. For example, real estate information in the United States is open and transparent. Homebuyers can directly visit government websites to view all detailed information about their intended properties, which gives them a strong sense of confidence. Moreover, the US government will take good care of the property rights of homeowners, and in the process of real estate transactions, it can also protect the rights of both buyers and sellers. Overall, it is relatively fair and just. For those who plan to settle in the United States in the future, investing in American real estate now is also preparing for the future. Even if you don't plan to live in the United States temporarily, you can still rent out your house first, which can earn rental fees. If you persist in the long run, you can gradually recover investment costs. 2、 Introduction to Sonata Estates Real Estate Project in Dallas If you are interested in investing in real estate in the United States, we would like to recommend a highly cost-effective project to you, which is the Sonata Estates real estate project in Dallas. Project Highlights-Convenient transportation and well-developed logistics in the area: The location of this project has convenient transportation and well-developed logistics in the area.-Dallas has the highest population inflow in the United States and rapid economic growth. Its population inflow is also among the highest in the country, and its economic growth is particularly rapid, which can greatly promote property appreciation.-The government's key development areas have great potential for appreciation: The area where the project is located is a government key development area, and the future appreciation potential is great, which is very suitable for long-term investment.-The only long-term rental villa project for sale in the southern part of Dallas has a strong demand for housing. It is the only long-term rental villa project for sale in the southern part of Dallas, and the housing demand is particularly strong, which means the rental market is very good.-* * Strong developer's ready to use fully furnished detached villa * *: It is built by a strong developer, and it is a ready to use or fully furnished detached villa with guaranteed quality. Project Introduction-Diversified resident composition, profound historical heritage, and thriving new city: The place where this project is located has a rich and diverse resident composition, as well as a profound historical heritage, making it a thriving new city. -The Ellis project is located at the confluence of Interstate 35E, Highway 287, and Highway 77, serving as a transportation hub connecting major public facilities and large employment centers. It is like a transportation hub that can easily connect to major public facilities and large employment centers. -There are countless leisure and entertainment attractions such as 18 parks and golf courses around the project. Within 10 minutes of the project, there are over 20 restaurants, large retail malls, banks, post offices, and gas stations available. There are also many leisure and entertainment attractions around the project, including 18 parks and golf courses. Moreover, within a 10 minute radius of the project, facilities such as catering, retail malls, banks, post offices, and gas stations are readily available, making life more convenient. -Within 10 minutes of the project, 13 clinics ranging from small clinics to large hospitals are equipped. As well as the developed public universities in the area, Southwest Catholic University and Navarro College at Waxahachie campus, with a student population of over 3000 * *: Within 10 minutes of the project, there are 13 medical institutions, ranging from small clinics to large hospitals. There are also well-developed public universities in the area, such as Southwest Catholic University and the Waxahachie campus of Navarro College, with a student population of over 3000 and abundant educational resources. -The local cultural life of the project is rich, attracting tourists from all over the United States through various festivals and celebrations throughout the year, including the Texas Film and Music Festival, Renaissance Festival, which attracts 200000 tourists annually. There are also ancient architecture tours, Texas Rural Expo, World War II Victory Memorial, and many other festivals and religious celebrations. The cultural life here is very rich, with many festivals and celebrations throughout the year, such as the Texas Film and Music Festival, Renaissance Festival, etc., which can attract 200000 tourists every year. There are also ancient architecture tours, Texas Rural Expo, World War II Victory Memorial, and many other festivals and religious celebrations. Living here is definitely very interesting. Project Information-* * Property type: Single family villa * *: The property type of this project is a single family villa, which is very comfortable to live in.-* * Project layout: 3-bedroom 2.5 bathroom 2 garage/4-bedroom 3.5 bathroom 2 garage * *: There are two types of layouts to choose from, one is 3-bedroom 2.5 bathroom 2 garage, and the other is 4-bedroom 3.5 bathroom 2 garage.-* * Sales volume: Total quantity of 127 sets * *: The total number of sets to be sold is 127 sets.-* * Floor area: 4000-6000 square feet * *: The floor area of each villa is between 4000-6000 square feet.-* * Building area: 2100-2500 square feet * *: The building area is between 2100-2500 square feet.-* * Construction period: 12 months * *: It takes approximately 12 months from start to completion.-* * Project Property Rights: Permanent Property Rights, Loan Available * *: The property rights of this project are permanent property rights, and loans can also be obtained, making investment more convenient. Project location-Sonata Estates is located in Waxahachie, Texas, adjacent to highways 35E, 287, and 77, and is an important transportation hub in the southern part of Dallas. This area is known as the "Crossroads of Texas" and is closely connected to major cities and facilities. Sonata Estates is located in Waxahachie, Texas, adjacent to highways 35E, 287, and 77, and is an important transportation hub in southern Dallas. This area is also known as the "Crossroads of Texas" and has close connections to major cities and various facilities. Distance from downtown Dallas -30 minutes by car; 50 minutes' drive from the city center of Vorzburg; 13 minutes' drive from the intermediate airport; 41 minute drive from Love Field Airport; Distance from DFW International Airport -51 minutes by car * *: It's only a 30 minute drive from downtown Dallas, a 50 minute drive from downtown Vorzburg, a 13 minute drive from Midway Airport, a 41 minute drive from Love Field Airport, and a 51 minute drive from DFW International Airport. Travel is quite convenient. Project highlights (emphasized again)-Superior geographical location: The project is located in Waxahachie, with developed transportation, connecting highways 35E, 287, and 77. It is only a 30 minute drive from downtown Dallas, making it convenient to travel between major commercial centers and the city's core areas. Once again, the project's geographical location is really advantageous, with well-developed transportation that can connect to several highways. It is only a 30 minute drive from downtown Dallas, making it easy to reach major commercial centers and the city's core areas. -Stable investment return: Provides 3-year or 10-year leasing services with an annual net income of 5%, bringing long-term stable returns to investors. Moreover, this project can also provide 3-year or 10-year leasing services with an annual net income of up to 5%, which can bring long-term stable returns to investors. Isn't it great? -Dallas has the highest population growth in the country: The continuous influx of population in Dallas drives demand in the local real estate market, ensuring the potential for property appreciation. Dallas' population has been continuously flowing in, ranking first in the country, which drives demand in the local real estate market and ensures great potential for property appreciation. Government key development area: The project is located in a government key support area with huge potential for future appreciation, suitable for long-term investment * *: The project is located in a government key support area with great potential for future appreciation, especially suitable for long-term investment. Scarce investment opportunity: As the only long-term rental villa project for sale in the southern part of Dallas, Sonata Estates provides investors with a unique market opportunity to meet the strong rental demand. * *: It is the only long-term rental villa project for sale in the southern part of Dallas, providing investors with a unique market opportunity to meet the strong rental demand. Strength developer guarantee: Built by well-known developers, the high-quality construction and delivery of ready to use houses of the project ensure the safety of investors' home purchases and reduce uncertainty risks * *: Built by well-known developers, the high-quality construction and delivery of ready to use houses of the project can ensure the safety of investors' home purchases and reduce uncertainty risks, making your investment more reassuring. I hope the above introduction can give you a clearer understanding of real estate investment in the United States and the Sonata Estates property project in Dallas. If you are interested in investing, you may want to consider it more.

2024-11-21View Details

Five advantages of purchasing US real estate

According to a report released by the National Association of Real Estate Brokers, Chinese buyers have been the group buying the most properties in the United States for ten consecutive years. Subsequently, five reasons for choosing to invest in properties in the United States were explained, including resistance to inflation, high investment returns, permanent property rights, tax deductible expenses, and sound legal protection. The aim is to provide readers with a clear understanding of the attractiveness of investing in properties in the United States.In the United States, the real estate market has always been closely watched. According to the "2023 Overseas Buyers Report for Residential Real Estate in the United States" released by the National Association of Real Estate Brokers, Chinese buyers have become the group that purchases the most properties in the United States for the tenth consecutive year. Why is buying a house so attractive in the United States? Whether it's to ensure stable asset appreciation or to maintain control over property, the US real estate market always seems to have something captivating. Today, let's explore together the top five reasons for choosing to invest in real estate in the United States.1、 Resist inflationEveryone knows about inflation, which simply means that the purchasing power of money has decreased, and money is not as "valuable" as it used to be. To deal with this situation, many people choose to invest in real estate. Why is that? Compared to other investments, real estate generally has a better effect of preserving and increasing value. In the United States, it is widely believed that real estate is an effective investment method that can resist inflation. Why do you say that? Because the value of real estate and rent often increase along with the rise in prices, this allows your money to "maintain value" and even "increase in value" during inflation.2、 High return on investmentThe US real estate market has an advantage in terms of investment return compared to other types of investments. What is an advantage method? After deducting all relevant expenses, including but not limited to maintenance costs, management fees, property taxes, and insurance premiums, the net rental yield can usually reach 3.5% to 4.5% in the first year. In the second year, it may even increase to 4.5% to 6%, not to mention the additional income that the property itself may bring due to market appreciation. So considering both rental income and asset appreciation, the annual return rate is usually conservatively estimated to be between 8% and 10%. Isn't that quite good?3、 Perpetual property rightsThe great advantage of buying a house in the United States is that as long as you pay the relevant taxes and fees in accordance with the law, the ownership of the property can be considered permanent. What does this mean? As long as you consistently fulfill your financial obligations, such as paying taxes on time, there is no risk of your property being forcibly demolished or confiscated. This stability is very attractive to investors because it almost eliminates all the uncertainties that may arise from policy changes, making you feel particularly at ease.4、 Expense tax deductionIf you have a visa, green card, or are a US citizen for more than 180 days, you will automatically be considered a US tax resident and will have to file taxes based on your income. However, there is good news here. If you have property in the United States and also register your own company to work from home, you can use some of the expenses related to the property, such as property taxes, insurance premiums, cleaning fees, utilities, etc., to make tax deductions. In this way, not only can it reduce your tax burden, but it also makes investing in real estate more attractive. Doesn't it feel quite cost-effective?5、 Sound legal protectionThe real estate legal system in the United States has undergone almost a century of development and has now become quite sophisticated. For investors, this provides a particularly safe environment. Almost all information related to real estate is open and transparent, such as transaction history, tax information, and current owners, which can ensure that the market is fair and transparent. The soundness of this law not only protects the rights and interests of homebuyers, but also provides investors with a relatively stable and predictable investment environment, giving you more confidence when investing.So, considering these five reasons, it is not difficult to understand why the US real estate market is so attractive, and why Chinese buyers have been the group buying the most US properties for ten consecutive years. I hope that through this article, everyone can have a clearer understanding of real estate investment in the United States.

2024-11-21View Details

What changes do homebuyers need to be aware of when the new US housing regulations come into effect?

The new regulations in the US real estate market in 2024 have brought significant changes to the home buying process and commission structure, reshaping the market competition environment and affecting ordinary buyers and sellers. Next, we will elaborate on the specific changes that have occurred in the commission structure and home purchase process With the opening of 2024, the US real estate market has entered a new stage, and the introduction of a series of new regulations is like a giant stone thrown into a lake, causing ripples and having a profound impact on the entire market. These new regulations have not only reshaped the home buying process, but also made significant reforms to the commission structure, thereby significantly changing the market competition environment. Whether ordinary buyers with dreams of buying a house or sellers who hope to sell their houses smoothly, they have personally felt the impact of these changes. Today, Xiaoqiao will lead everyone to deeply understand the specific changes that have occurred in the market under this wave of new regulations. Changes in commission structure Before the implementation of the new regulations in the real estate market, the presentation of the entire commission structure was relatively fixed. When seller brokers list property information on MLS (Multi Listing Service System), the commission rate is displayed to the public as an open and transparent part. Normally, sellers are required to bear a commission of 5% to 6% of the total selling price, which is used to cover the service fees of brokers for both buyers and sellers. Take a property priced at $1 million as an example, according to this ratio, the commission fee can be as high as $50000 to $60000. Moreover, this expense is often not separately listed, but indirectly included in the housing price, which to some extent pushes up the market transaction price. However, the implementation of the new regulations is like a heavy hammer, completely breaking the original commission pattern. The new regulations clearly stipulate that MLS platforms will no longer allow the display of commission information that sellers are willing to pay to buyer brokers. This measure is of great significance as it gives new flexibility to commission payments. Specifically, although the seller and their agent can still choose to bear the cost of the buyer's agent, the entire negotiation process needs to shift from being open and transparent to being conducted privately. Both parties need to reach a consensus on commission payment through private negotiations. The direct impact of this transformation is that buyers may face a new situation where they need to bear the cost of cooperating with their own brokers, making the fee structure of brokerage services more flexible and personalized. However, it is worth noting that although the new regulations have officially come into effect, the current mainstream trading model in the market still tends to continue the previous practice, which is for sellers to continue to bear all commission fees. This is mainly determined by the fact that the market is in a transitional period. On the one hand, many listing contracts for real estate sales have already been signed before the new regulations were introduced, and the commission clauses in these contracts cannot be adjusted immediately at present; On the other hand, the current real estate market situation is gradually tilting in favor of buyers. In this situation, sellers often choose to continue bearing commission costs in order to accelerate the speed of property transactions and attract more buyers to pay attention to their properties. Changes in the purchasing process At the same time as the commission structure has changed, the purchasing process has also undergone significant changes. The new regulations require buyers to sign a legally binding agency agreement before enjoying broker guided viewing services. The importance of this agency agreement is self-evident. It is not only the cornerstone for establishing a cooperative relationship between the buyer and the broker, but more importantly, it clearly and explicitly defines key content such as the broker's service scope, compensation mechanism, and potential cost sharing. This also means that if the seller refuses to pay the broker's commission, the buyer needs to be mentally prepared in advance and bear the cost themselves. Faced with such new regulations, we offer some suggestions to buyers. Before officially signing with the agent, buyers can actively participate in the Open House event and accumulate relevant experience through independent house viewing. When it is finally decided to cooperate with a broker, it is necessary to carefully review the contract terms, especially those crucial terms such as commission payment, service content, and contract termination, in order to ensure that one's legitimate rights and interests are fully protected. Meanwhile, a thorough understanding of the conditions and procedures for contract termination is also an essential preparation for every homebuyer in the process of purchasing a house.

2024-11-21View Details

After Trump's victory, the real estate market in Palm Beach, Florida is extremely hot

Hey, real estate enthusiasts! Today I want to talk to you about the bustling real estate market in Palm Beach, Florida. Everyone knows that since Trump's victory in the election, the real estate market in Palm Beach has been ignited like a fire, instantly becoming super hot and attracting a lot of attention. There are many celebrities and big names here, such as Kelsey Glamour, the well-known former lead actor of 'Happy Family'. 1、 The booming scene of Palm Beach real estate market under the Trump crazeThe 'Trump craze' triggered by Trump's victory is truly influential. As soon as it arrived, the local real estate agents were so busy that they were dizzy and disoriented. The phone kept ringing, and the itinerary for showing clients properties was packed with schedules that they couldn't even spare a moment. And oh, this trend not only keeps intermediaries busy, but also successfully attracts the attention of many celebrities and big names. These big stars who usually shine on the screen have turned their gaze to Palm Beach, a land full of opportunities, hoping to find their dream home here. Margaret Brent, a top real estate agent in Palm Beach, revealed a very shocking situation. She told Fox Business Channel anchor Maria Bartirom that since the last week after the election, the real estate market in Palm Beach has experienced an unprecedented boom. Within that week alone, properties worth $100 million were put up for sale, and that's not all. As of November 13th, an additional $25 million worth of properties were added for sale. Wow, isn't this number really scary? It shows how hot the market was at that time! 2、 Kelsey Glamor's buying trend in Palm BeachIn this trend, Kelsey Glamour, a celebrity and big shot, is highly anticipated. According to informed sources, Glamor has been busy searching for his desired residence in the Palm Beach area recently. This actor who rose to fame in Friends was even seen browsing a mansion worth 12.9 million dollars. The location of this mansion is quite unique, it is located in West Palm Beach and is jointly owned by Trump's super spenders Bill White and Brian Youle. This mansion located at 2916 Washington Road is truly charming. It not only has charming waterfront scenery, but standing there, you can also see Trump's private estate - Mar-a-Lago Estate from afar. Imagine waking up every morning and being able to see the famous Mar-a-Lago Manor at a glance. Isn't it really amazing! A source familiar with the matter said, "Being able to live near President elect Trump has stirred up the real estate market here. Now, everyone is eager to join this unique circle and become a part of it." And oh, the threshold for joining this circle is very high, with membership fees skyrocketing to over $1 million. Even so, there is still a long waiting list behind, which shows how popular this place is! However, regarding Glamor's home purchase plan, his agent hasn't said anything and hasn't made any comments yet. But this doesn't prevent us from guessing, after all, Glamour openly supports Trump, and everyone is wondering if he really plans to settle down in Palm Beach. Actually, as early as last year, Glamour revealed in an interview with Radio 4 that he planned to vote for Trump. Although he was promoting a certain project at the time and was interrupted by public relations personnel before he could finish speaking, his support for Trump's position was clear. 3、 The relationship and influence between Sylvester Stallone and TrumpBesides Glamour, there is also a Hollywood star who has a close relationship with Trump, and that is Sylvester Stallone. Stallone is really impressive. He even personally introduced the elected president at a party held at Trump's Mar-a-Lago estate. This move undoubtedly proves that Trump is also quite popular in Hollywood and has a considerable appeal to these celebrities. 4、 The unique charm and advantages of the mansion at 2916 Washington RoadLet's talk about the mansion located at 2916 Washington Road again. It is truly an ideal residence that people yearn for. According to information on Realtor, this mansion has unparalleled privacy and uniqueness. It is located in a private, enclosed area, like a secluded little world, and living inside is full of security. And oh, it also has a direct passage to the private dock. When you have free time, walk along the passage to the dock, enjoy the sea breeze, and see the sea view. It feels incredibly comfortable. Looking out from here, you can also enjoy the magnificent scenery from 'The Breakers' to Mar-a-Lago Manor. Living here, you can enjoy unobstructed views from sunrise to sunset every day. At the same time, you can also walk or ride a bicycle to nearby popular dining destinations, enjoying both the beautiful scenery and satisfying your taste buds. It's simply amazing! Oh, by the way, there are many surprising things about this mansion. It has a spacious half acre plot of land where you can freely create your favorite garden or leisure area. Moreover, there is a dock directly connected to the dock equipped with lifting devices, which is really convenient for people who enjoy water activities. These facilities undoubtedly make this mansion more charming and practical. For home buyers who pursue a high-quality life and crave to enjoy the beauty of nature and private space, this mansion is simply a rare choice. 5、 The attractiveness of Palm Beach real estate market to investors and homebuyersActually, the real estate market in Palm Beach has not only attracted the attention of celebrities and big names. With the arrival of the Trump era, more and more investors and homebuyers are also paying attention to this land full of opportunities. They all believe that under Trump's leadership, the US economy will definitely develop even more prosperous. As one of the important cities in Florida, Palm Beach is sure to benefit as well. So, everyone thinks that investing in real estate or buying a house here may bring good returns. How about it, friends? Are you also interested in the real estate market in Palm Beach? If you have any ideas, please feel free to leave a comment in the comments section. Let's chat together!

2024-11-21View Details